The customs clearance procedure for import and export goods consists of 5 basic steps. Let’s explore the details of this process!

1 What is Customs Procedure?

According to the 2014 Customs Law:

23. Customs procedure refers to the tasks that the declarant and customs officers must perform according to the provisions of this Law for goods and means of transport.

The customs procedure for exported goods includes the following steps:

- Check the commodity and tax policies.

- Prepare documents.

- Complete the customs declaration.

- Complete export customs procedures at the customs office.

- Clearance and declaration settlement.

2 Basic Procedure for Customs Clearance of Exported Goods

Check the commodity and tax policies to better understand the goods you intend to export

Check the commodity and tax policies to better understand the goods you intend to export

Step 1 Check the Commodity and Tax Policies

This step is crucial to determine if the state policies encourage, restrict, or prohibit the export of your commodity. You can refer to the List of Taxable Export Commodities for more information.

Additionally, you need to find out if your commodity is subject to export tax. Some commodities that are taxed include minerals (coal, stones, ores, precious metals, etc.), forestry products (wood, wood products), etc.

Step 2 Document Preparation

Ensure you have all the necessary documents for the customs procedure

Ensure you have all the necessary documents for the customs procedure

The following documents are required for the customs procedure for exported goods:

- Foreign trade contract.

- Commercial invoice.

- Packing list.

- Stowage agreement to obtain information including: vessel name, voyage number, and port of export.

- Container yard receipt to obtain information such as container number and seal number.

In the case of special goods that require specialized inspection, you need to prepare additional documents as per current regulations. For example, if you are exporting wood or wood products, you must prepare a forestry dossier with the confirmation stamp of the forest ranger, or if you are exporting seafood, you will need animal health certificates, etc.

Step 3 Complete the Customs Declaration

Complete the customs declaration by accessing the software

Complete the customs declaration by accessing the software

To complete the customs declaration, access the electronic customs software to enter data into the customs declaration form.

If you are exporting or importing for the first time, you need to perform the following additional steps:

- Purchase a digital signature and register it with the General Department of Customs.

- Download and install the electronic customs declaration software. After installing the software, enter the cargo information into the software and print the customs declaration form.

Step 4 Complete Export Customs Procedure at the Customs Office

The export customs procedure at the customs office is divided into three streams

The export customs procedure at the customs office is divided into three streams

The export customs procedure at the customs office is categorized into the following streams:

Green Stream Declaration

You need to submit the following documents to the customs supervisor:

- Cargo manifest.

- Barcode sheet printed from the website of the General Department of Customs.

- Infrastructure fee (applicable only at Hai Phong Port).

Yellow Stream Declaration

You need to prepare a paper dossier as per Circular 38 (amended in Circular 39) and submit it to the customs office for officers to review. In some cases, you can attach scanned files to the electronic declaration without submitting hard copies.

The paper dossier as per Circular 38 includes:

- Customs export declaration form.

- Commercial invoice.

- Original copy of the timber schedule as per regulations if the exported goods are raw wood, along with the export license issued by the competent authority.

- Original copy of the notice of exemption from specialized inspection or the results of the specialized inspection.

- Copy of the document proving eligibility for export as per regulations.

- Copy of the entrustment contract.

Red Stream Declaration

For declarations in the red stream, the customs authority will physically inspect the goods after reviewing the documents.

If your goods differ from the declared ones, minor errors can be rectified by amending the declaration, while major errors may result in administrative penalties or export prohibition due to serious violations.

Step 5 Clearance and Declaration Settlement

Submit the declaration and barcode sheet to the shipping company and the customs supervisor.

In this step, submit the declaration and barcode sheet to the shipping company to initiate the actual export confirmation procedure with the customs supervisor once the goods are loaded onto the vessel.

3 Basic Procedure for Customs Clearance of Imported Goods

According to Vietnamese law, the basic procedure for customs clearance of imported goods includes the following steps:

Step 1 Identify the Type of Imported Goods

It is essential to identify the type of imported goods to determine the necessary procedures. For instance, if the goods are ordinary, no special attention is required, but if they are subject to conformity or compliance declaration, the enterprise must complete the conformity declaration procedure before the goods arrive at the port…

Identify the type of imported goods

Identify the type of imported goods

Step 2 Check the Goods’ Documents

During the customs procedure, enterprises need to prepare a set of documents, which basically includes the following:

- Commercial contract (Sale Contract).

- Bill of Lading (BoL).

- Packing List.

- Certificate of Origin (C/O).

- Commercial Invoice.

Check the goods’ documents

Check the goods’ documents

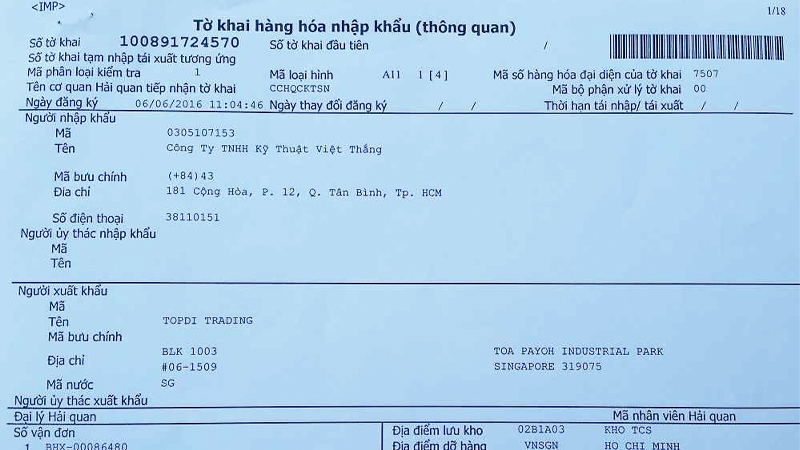

Step 3 Complete and Submit the Customs Declaration

After receiving the cargo notice from the shipping company, the enterprise needs to prepare the customs declaration and fill in all the necessary information. Once the declaration is completed and submitted, the system will automatically assign a number if the information is accurate and complete.

Step 4 Obtain the Delivery Order

The enterprise needs to prepare the following dossier and submit it to the shipping company to obtain the delivery order:

- Copy of ID/Citizenship card.

- Copy of BoL.

- Original BoL with a stamp.

Obtain the delivery order

Obtain the delivery order

Step 5 Prepare the Customs Dossier

After the declaration is submitted, the system will categorize the goods into green, yellow, or red streams.

- Green Stream: The enterprise prints the declaration and pays the tax.

- Yellow Stream: The customs authority examines the paper dossier of the goods.

- Red Stream: The goods are physically inspected.

Step 6 Pay Taxes and Complete Customs Procedures

After the declaration is submitted and approved, the enterprise needs to pay two main types of taxes:

- Import tax.

- VAT.

Pay taxes and complete customs procedures

Pay taxes and complete customs procedures

Additionally, depending on the type of goods, environmental protection tax and special consumption tax may also be applicable.

Step 7 Transfer the Goods to the Warehouse for Storage

Finally, transfer the goods to the warehouse for storage.

The above information provides an overview of the basic customs clearance procedure for exported goods. We hope you find it helpful.