What are the requirements for a husband to claim maternity benefits? How much social insurance will he receive? These are considered basic questions about maternity benefits for husbands when their wives give birth.

Since September 1st, 2021, the Ministry of Labour, Invalids and Social Affairs has made adjustments to the maternity benefits for husbands when their wives give birth according to Circular No. 06/2021/TT-BLDTBXH. Therefore, to understand the procedures for claiming maternity benefits for husbands, please refer to this article.

1 What are the documents required for a husband to claim maternity benefits?

Registration documents

Registration documents

To claim maternity benefits for a husband, you need to prepare the following documents:

-

Birth certificate with the father’s name or birth certificate, household registration book.

-

In case of child death: Death certificate or child’s death certificate. Or a copy of the mother’s medical record or discharge paper if the child dies after birth but has not been issued a birth certificate.

-

Confirmation from the medical facility in case of preterm birth before 32 weeks or cesarean section (if any).

2 Conditions and time off work to claim benefits

Conditions and time off work to claim benefits

Conditions and time off work to claim benefits

Conditions: Male workers who are insured and have social insurance contributions are entitled to maternity benefits when their wives give birth.

Time off work to claim benefits:

-

05 working days for a normal delivery of one child.

-

07 working days if the wife gives birth by cesarean section or if the baby is born before 32 weeks of pregnancy. However, if twins are born by cesarean section, the husband is entitled to 14 working days off.

-

10 working days for twins or triplets, plus 3 working days, and a maximum of 14 working days.

-

The benefit period does not include holidays, weekends, or other days off.

Note: Male workers can take multiple breaks during the first 30 days after their wife gives birth, as long as the total number of days off does not exceed the limit specified above.

3 How much social insurance will the husband receive for maternity benefits?

Social insurance benefit amount for husbands

Social insurance benefit amount for husbands

Benefit amount = Mbq6t / (24 working days) x 100% x number of days off.

Where:

Mbq6t: Average salary of the last 6 months before the wife’s delivery; If less than 6 months, Mbq6t = average salary of the insured months.

For example: The average insured salary for the last 6 months before the wife’s delivery is VND 6,000,000, and you are entitled to 7 days off (because the wife had a C-section)

=> Calculation as follows:

Mbq6t = (6 x VND 6,000,000) / 6 months = VND 6,000,000

Benefit amount = VND 6,000,000 / 24 x 7 = VND 1,750,000

4 What if the wife does not have social insurance and the husband wants to claim benefits?

Husband’s benefit entitlement

Husband’s benefit entitlement

The husband’s benefit entitlement is specified as follows:

-

According to Point c, Clause 2 Document No. 3432/LDTBXH-BHXH dated September 8, 2016, of the Ministry of Labour, Invalids and Social Affairs, male workers whose wives do not meet the conditions to enjoy maternity benefits (not insured or not insured for a sufficient period).

-

The husband must have social insurance contributions for at least 06 months within the 12 months before the wife’s delivery.

-

The husband of a surrogate mother must have social insurance contributions for at least 06 months within the 12 months before receiving the child.

One-time allowance = 2 x Basic salary

Details: According to Clause 9 of Decision No. 636/QD-BHXH dated April 22, 2016, the basic salary applied from July 1, 2016, to June 30, 2017, is VND 1,210,000 per month. The basic salary applied from July 2, 2017, to June 30, 2018, is VND 1,300,000 per month. From July 1, 2018, the basic salary is VND 1,390,000 per month.

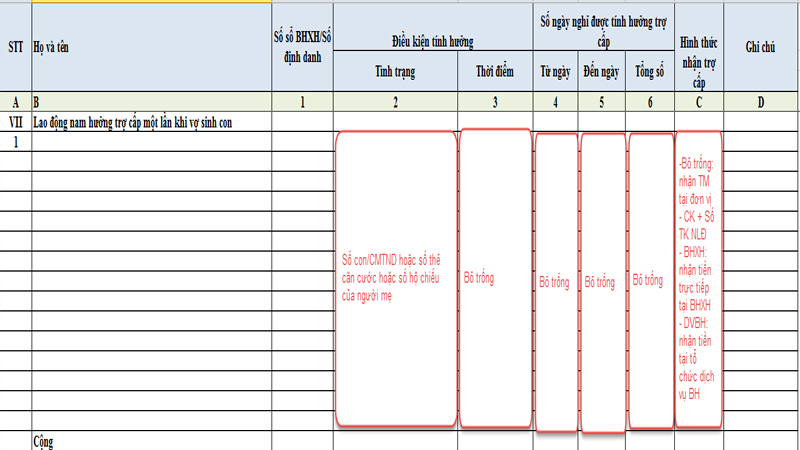

5 How to fill out Form C70a-HD to claim maternity benefits

Social insurance benefit amount for maternity benefits for husbands

Social insurance benefit amount for maternity benefits for husbands

Male workers can take time off work when their wives give birth

Male workers are entitled to a one-time allowance when their wives give birth

Declaration form

Declaration form

Columns A, B: Enter the full name and details of the new beneficiary.

Column 1: Enter the social insurance number or identification number of the beneficiary.

Column 2: Status: Enter the day off if it is not Saturday or Sunday; and also enter the number of children born/ID number or passport number or identity card number of the mother/delivery method or number of weeks of pregnancy if the baby is born before 32 weeks.

For example: An employee working at a supermarket has Mondays off; his wife gave birth to triplets by C-section; his wife’s ID number is 123456789

Then enter: Monday/3/ID123456789/CS

Column 3: Timing: Leave blank as per Decision No. 636/QD-BHXH

Column 4: From: The first day of leave

Column 5: To: The last day of leave

Column 6: Total: Total number of days off, excluding weekends, holidays, and other days off

Column 7: Payment method:

-

Leave blank: The social insurance agency will transfer the money to the unit, and the male employee will receive the cash directly from the unit.

-

Transfer to the male employee’s bank account: The social insurance agency will transfer the money directly to the male employee’s account when the benefit is approved.

We have provided you with detailed information on the procedures for claiming maternity benefits for husbands when their wives give birth. Therefore, if you are interested in this issue, please follow the above article!