Just like other banks, ACB also supports customers in viewing ACB transaction histories in various ways. Specifically, you can check via Mobile Banking, Internet Banking, via SMS message, or by going directly to the bank. FPT Shop will guide you through the detailed steps.

Why check ACB transaction history?

Regularly checking transaction histories at ACB bank helps account owners to grasp changes in their accounts accurately. Here are some cases when you should look up ACB transaction history:

/fptshop.com.vn/uploads/images/tin-tuc/178443/Originals/xem-lich-su-giao-dich-acb-1.jpg)

- When your account has unusual fluctuations but you did not execute any transactions. At this time, by looking up the transaction history, you will know what the transaction was, when it took place, the amount of the fluctuation,…

- When you make a money transfer and the money has been deducted but the recipient has not yet received the money. Checking the transaction history as a form of proof that the transaction was successful.

- When you want to know how much money you have spent and for what purposes,… Thereby managing expenses and financial management more closely.

Instructions for 4 ways to view ACB transaction history

Customers can view ACB transaction history on their phones or go directly to the bank’s transaction counter depending on their actual situation. Here are detailed instructions for each method.

1. View ACB transaction history via ACB ONE

This is the method used by many people because it is quick and convenient. As you know, ACB ONE is a Mobile Banking application released for ACB customers. Through this application, you can check transaction history, account balances, and account information, and perform many types of transactions completely online.

/fptshop.com.vn/uploads/images/tin-tuc/178443/Originals/xem-lich-su-giao-dich-acb-2.jpg)

Currently, ACB ONE is available on the CH Play and App Store app stores, so it’s easy to download. However, to use it, you need to register for an ACB ONE account with the bank before logging in.

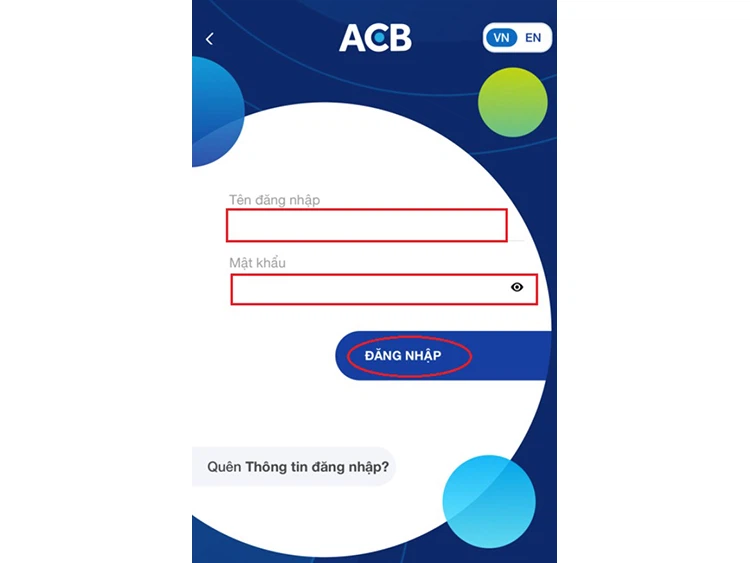

Step 1: Open the ACB ONE application and log in to your account.

/fptshop.com.vn/uploads/images/tin-tuc/178443/Originals/xem-lich-su-giao-dich-acb-3.jpg)

Step 2: At the main interface of the application, select the Accounts section.

/fptshop.com.vn/uploads/images/tin-tuc/178443/Originals/xem-lich-su-giao-dich-acb-4.jpg)

Step 3: If you are using multiple ACB accounts at the same time, select the account for which you want to view the transaction history.

/fptshop.com.vn/uploads/images/tin-tuc/178443/Originals/xem-lich-su-giao-dich-acb-5.jpg)

Step 4: Next, select Transaction history.

/fptshop.com.vn/uploads/images/tin-tuc/178443/Originals/xem-lich-su-giao-dich-acb-6.jpg)

At this time, all transactions will be displayed on the screen. If you want to see the details of any transaction, just click on that transaction.

2. View ACB transaction history via Internet Banking

If you are using a computer and cannot access the ACB ONE application, you can apply the method to view ACB transaction history via Internet Banking according to the following steps:

Step 1: In a web browser, you access this address then log in by entering your Username, Password and Authentication code then click Login.

/fptshop.com.vn/uploads/images/tin-tuc/178443/Originals/xem-lich-su-giao-dich-acb-7.jpg)

Step 2: After logging in successfully, at the main interface, you select the account for which you want to look up the transaction.

/fptshop.com.vn/uploads/images/tin-tuc/178443/Originals/xem-lich-su-giao-dich-acb-8.jpg)

Step 3: Next, you can limit the time frame of the transaction you want to look up. The system allows users to view directly on the web, export Excel files or Print statements if necessary.

/fptshop.com.vn/uploads/images/tin-tuc/178443/Originals/xem-lich-su-giao-dich-acb-9.jpg)

3. View ACB transaction history via SMS Banking

SMS Banking is an automated messaging service deployed by many banks, including ACB. When transactions are made on your account, the system will send a message notifying you of the balance change. You can review these messages to check your transaction history.

/fptshop.com.vn/uploads/images/tin-tuc/178443/Originals/xem-lich-su-giao-dich-acb-10.jpg)

If you have deleted the old messages and want to look them up this way, you can compose a message according to the following syntax:

ACB_LK_Account number send 997

In that:

- “_”: Space.

- Account number: Account number at ACB bank.

However, the form of checking by SMS message can only view a maximum of the last 5 transactions and previous transactions will not be checked.

4. Look up ACB transaction history at the transaction office

Another way to view ACB transaction history is to go directly to an ACB branch/transaction office. Here, bank tellers will assist you in searching and providing statements.

/fptshop.com.vn/uploads/images/tin-tuc/178443/Originals/xem-lich-su-giao-dich-acb-11.jpg)

When you go to the transaction office, you need to bring your ID card/CCCD and come during administrative working hours. If the bank has many customers, you need to queue up and wait. Because it takes more time than the 3 methods above, this method is used by few people, mostly the elderly or those who are not familiar with technology and do not have smartphones.

Conclusion

Through the 4 ways to view ACB transaction history that FPT Shop has just shared, I am sure that you have chosen the method that suits you. Hopefully, the article will help you check and manage your account in the best way.

See more information:

- Reveal 5 ways to view Vietinbank transaction history simply and in detail in 2024

- 05 Ways to look up MBBank transactions quickly and easily to better manage accounts

To use the ACB ONE app, you need a smartphone with an Internet connection and enough free memory to download the app. If you don’t have a suitable device yet, go to the FPT Shop store to choose a good machine for yourself.

View some best-selling Samsung phones here: