To ensure accuracy and transparency, the payroll statement has become an important process nowadays. So what is a payroll statement? How does it work? Let’s find out with FPT Shop!

What is a payroll statement?

A payroll statement is a notification that shows the detailed transactions of your monthly bank account in the most detailed way. The payroll statement will clearly show including expenses, wages, bills, service payments, etc.

Note: Only the cardholder has the right to request and perform a payroll statement.

/fptshop.com.vn/uploads/images/tin-tuc/176304/Originals/sao-ke-bang-luong-1.jpg)

Cases that require a payroll statement

A payroll statement is an important document when you need to use it for loan applications or credit card applications. Therefore, the payroll statement will be the basis for the bank to make a decision on whether to lend or not. At the same time, it also proves your ability to repay the bank. In addition, the payroll statement is also used for many different purposes such as:

- Registering for a visa to go abroad (export labor, tourism, etc.).

- Registering for unsecured loans based on payroll.

- Opening a credit card.

- Resolving disputes related to child custody or other disputes.

- Tracking the expenses of each individual.

/fptshop.com.vn/uploads/images/tin-tuc/176304/Originals/sao-ke-bang-luong-2.jpeg)

Content in the payroll statement

The payroll statement will include the following detailed information:

- Account/cardholder’s name.

- Account number.

- Date of statement.

- Beginning and ending balance.

- Transaction date.

- Posting date.

- Total number of transactions.

- Amount received and withdrawn.

- Account balance at specific times.

- Notes about the location of withdrawal, payment, etc.

- Transaction fees.

Note: Each legal payroll statement must have the embossed seal on the page and the circular stamp at the end.

/fptshop.com.vn/uploads/images/tin-tuc/176304/Originals/sao-ke-bang-luong-3.jpg)

How to obtain the payroll statement for the last 3 months and the last 6 months

Payroll statement at the bank

You can directly go to the bank’s transaction office to obtain the payroll statement. Here, you will need to show your ID card/Citizen Identification Card and request the teller to print the statement for your account based on the desired time frame.

/fptshop.com.vn/uploads/images/tin-tuc/176304/Originals/sao-ke-bang-luong-4.jpg)

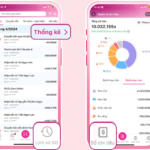

Online payroll statement

With this method, you need to be the one who has registered to use the internet banking service of the bank. Then, you will follow these steps:

Step 1: Access the banking app and log in.

Step 2: Go to the bank statement section (depending on the bank, this section may have different names such as transaction list, account inquiry, etc.).

Step 3: Select the desired time frame to view and inquire.

This method of obtaining a payroll statement will be suitable for people who do not have much time to go to the bank but want to control their transaction activities. However, it does not support editing or adding to loan records, proving assets, etc.

Payroll statement through ATM

This method is less commonly used than the previous one. You just need to go to the nearest ATM system and choose the account statement. Although it is quite fast, you cannot view all transactions within the month. Usually, you can only print the last 10 transactions.

Procedures for obtaining a payroll statement at the bank

Step 1: You need to identify the account that you registered to receive your salary from the company at which bank. If you own too many accounts, you need to choose the bank that you use most often.

Step 2: Prepare the necessary documents to verify your identity such as ID card, Citizen Identification Card, etc. If there are changes to the information registered with the bank, you should bring the conversion paper for verification. Then, when you meet the teller, you will request them to provide a payroll statement within a specific time frame.

Step 3: After receiving the payroll statement, you should double-check the information. Especially the seal and signature of the transaction staff or the circular stamp (in the case of a statement on 2 pages). If the statement does not have the bank’s authentication, it will not be valid in the case of litigation or disputes.

/fptshop.com.vn/uploads/images/tin-tuc/176304/Originals/sao-ke-bang-luong-5.jpg)

Is there a fee for the payroll statement?

The fee for a payroll statement will vary from bank to bank. Normally, this fee will be calculated per page and ranges from 5,000 VND to 50,000 VND. You can inquire in advance on the bank’s website or ask the teller directly.

/fptshop.com.vn/uploads/images/tin-tuc/176304/Originals/sao-ke-bang-luong-6.jpg)

Conclusion

Before obtaining a payroll statement, you should thoroughly understand your purpose to ensure your own rights. We hope that with the detailed ways to obtain a payroll statement shared by FPT Shop, you will successfully and effectively apply them.

- How to receive transaction history on Viettel Money app via email, simple and fast

- 04 ways to quickly view Vietcombank transaction history in 2023

To help you easily perform banking operations on your phone, FPT Shop introduces smartphone products such as OPPO, iPhone, Samsung,… with extremely preferential prices.