Be Wary of Imposters Posing as Bank Staff

In this age of sophisticated fraud, imposters are calling customers, pretending to be bank staff and offering to help with account balance and transaction inquiries.

After stating the customer’s name and the first six digits of their domestic debit card, the fraudster will ask the customer to provide the remaining card details for verification. They will then inform the customer that the bank will send a text message with a 6-digit code, which the customer is instructed to disclose. Complying with these requests will result in a loss of funds from the customer’s account.

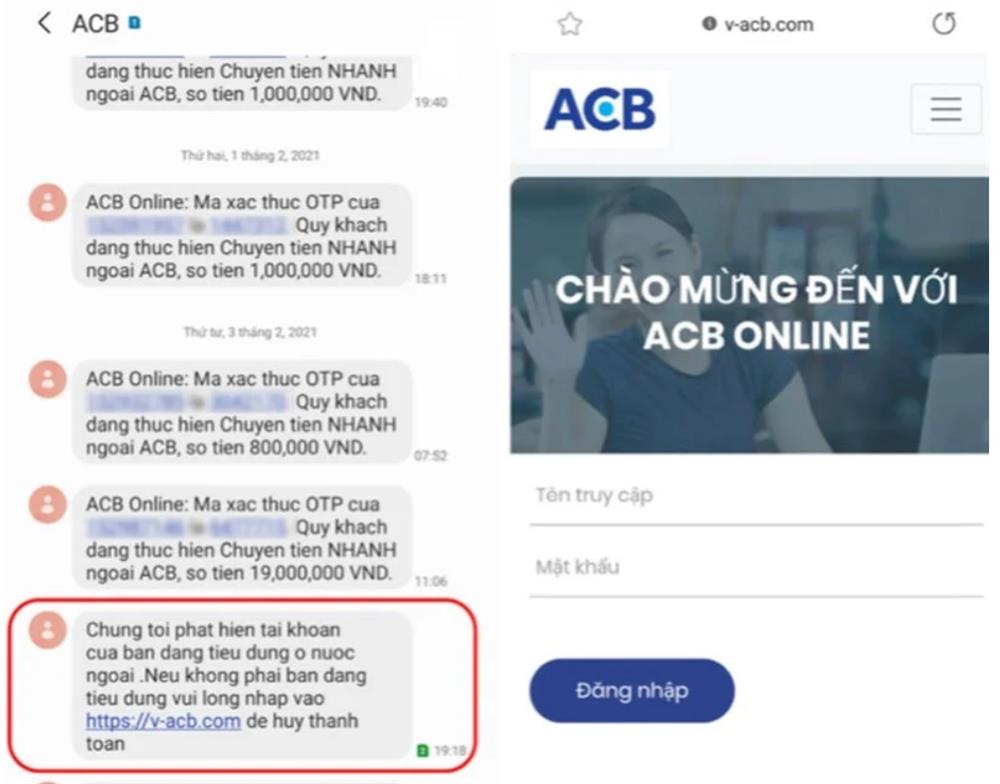

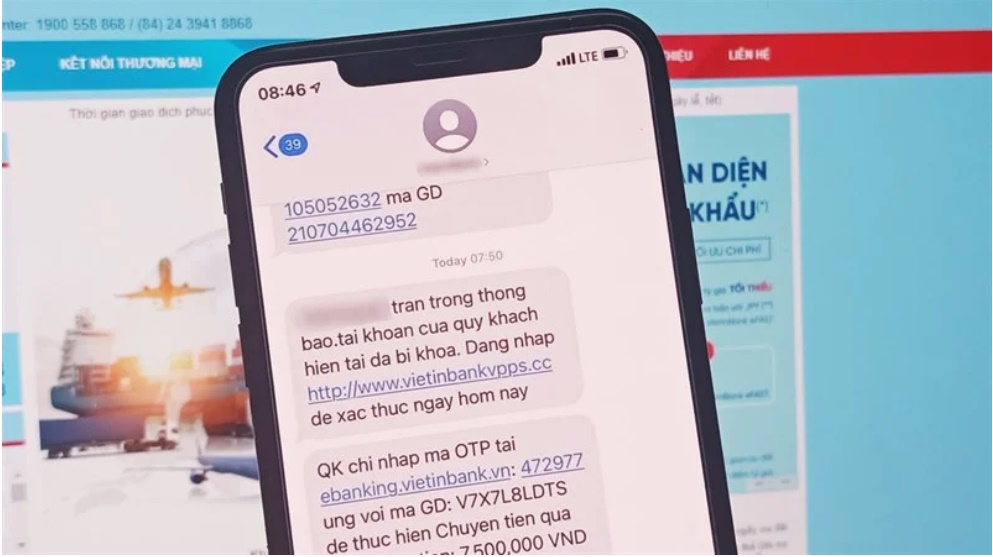

Beware of Suspicious Links

Scammers may transfer a small amount of money into a customer’s account and then pretend to be the bank, either by calling or sending a text message (disguised as the bank) to inform the customer that the transaction is on hold. They will then ask the customer to click on a link in the message to unblock the transaction, verify information, or perform other actions. By doing so, the fraudsters can gain access to the customer’s login credentials, passwords, and OTPs, ultimately taking control of their account.

Watch Out for Fake Emails

Customers may receive emails notifying them of a loan offer and asking them to confirm the transaction by accessing a malicious file or link attached to the email. The purpose of this is to steal the customer’s information and funds from their account.

Unexpected Loan Offers

Customers may receive a sum of money in their bank account with a “loan” transaction description. The scammer will then call the customer, claiming to have accidentally transferred the money and requesting that it be returned (to a different account than the one from which the money was supposedly sent). After some time, the “real” account holder will demand the money back, along with interest.

Imposters Posing as Finance Company Employees

Fraudsters have been impersonating finance company employees, offering loans to customers, and displaying fake credit contracts with forged signatures and company seals. They trick customers into transferring a deposit amount to secure the “loan,” only to abscond with the funds.

In this modern era, scammers are constantly devising new and creative ways to defraud people. Therefore, it is crucial to be vigilant and verify any suspicious activity before taking action.

According to Khoevadep