Personal income tax is a significant contributor to the state budget, ensuring social security and promoting economic development. It is the duty and responsibility of every citizen to pay their taxes in full and on time. However, many people still have concerns about how to check their individual tax debts and whether they have overpaid their taxes. This article will provide you with detailed information and specific instructions to address these queries.

1 Why Do You Need to Check Your Individual Tax Debt?

There are several reasons why checking your individual tax debt is important:

-

Understand your tax obligations: Checking your tax debt helps you know the amount of personal income tax you need to pay to the state budget for each tax period.

-

Avoid penalty interest: If you owe taxes, you will be subject to penalty interest as per the law. Therefore, regularly checking your tax debt helps you detect and pay on time to avoid additional costs.

-

Request tax refunds: If you have overpaid your personal income tax, you have the right to request a refund. Checking your tax debt helps you identify the excess amount and initiate the refund process.

-

Monitor your personal finances: Checking your tax debt is a useful way to keep track of your personal finances. This enables you to manage your expenses wisely and make more informed financial decisions.

Why is it necessary to check individual tax debt?

Why is it necessary to check individual tax debt?

2 How to Check Your Individual Tax Debt?

There are currently two main ways to check your individual tax debt:

Checking through the Electronic Portal of the General Department of Taxation

Access the website

Access the website

“Inquiry” -> “Inquire about tax obligations”.” class=”imgcontent” data-id=”2″ src=”https://cdn.tgdd.vn/Files/2024/05/31/1566342/tra-cuu-no-thue-ca-nhan-nhu-the-nao-lam-sao-biet-minh-co-nop-du-thue-hay-khong-202405311343465692.jpg” title=”Select “Electronic Services” -> “Inquiry” -> “Inquire about tax obligations”.”>Select “Electronic Services” -> “Inquiry” -> “Inquire about tax obligations”

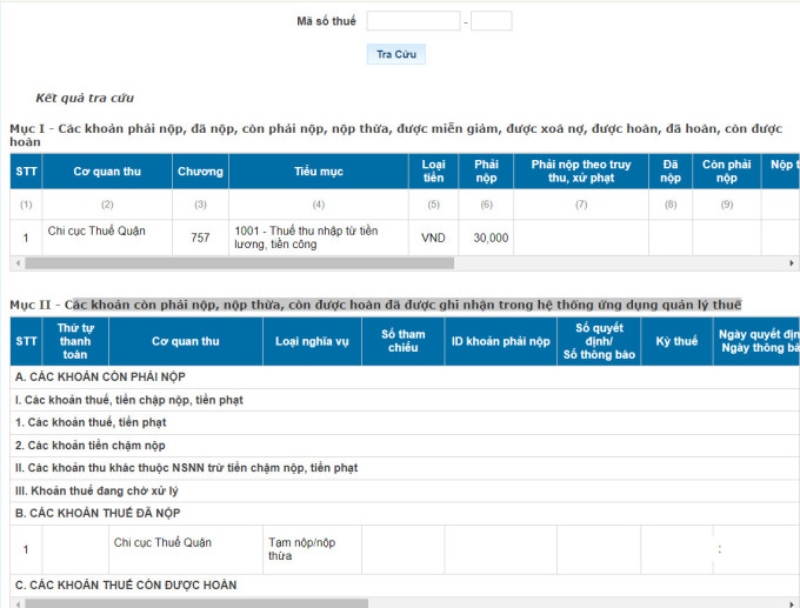

Choose the tax period you want to inquire about and click the “Inquire” button.

Choose the tax period you want to inquire about and click the “Inquire” button.

Checking through the eTax Mobile Application

Download the eTax Mobile application

Download the eTax Mobile application

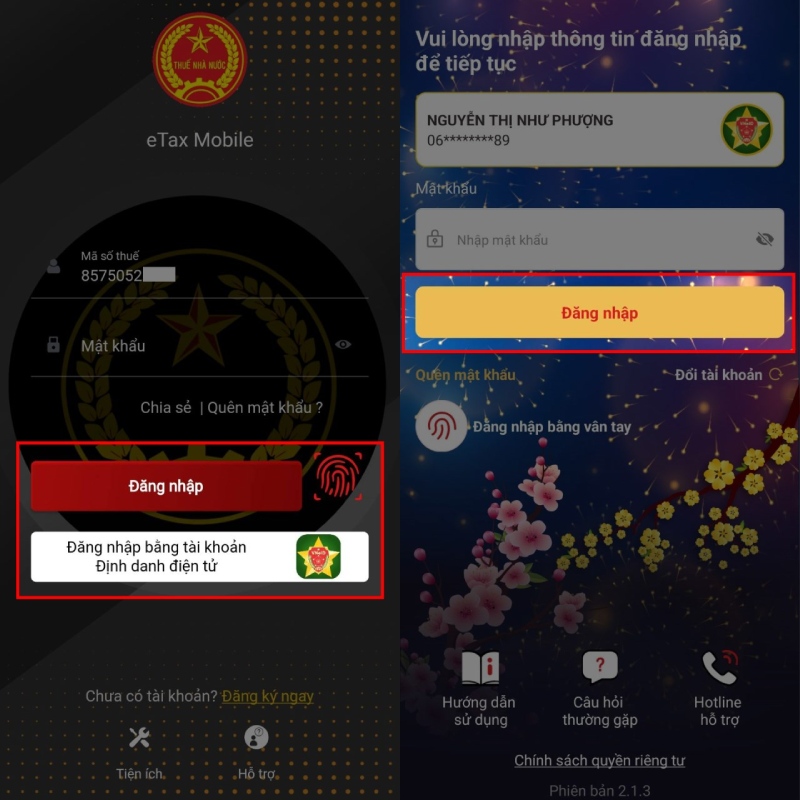

Access the eTax Mobile application and log in

Access the eTax Mobile application and log in

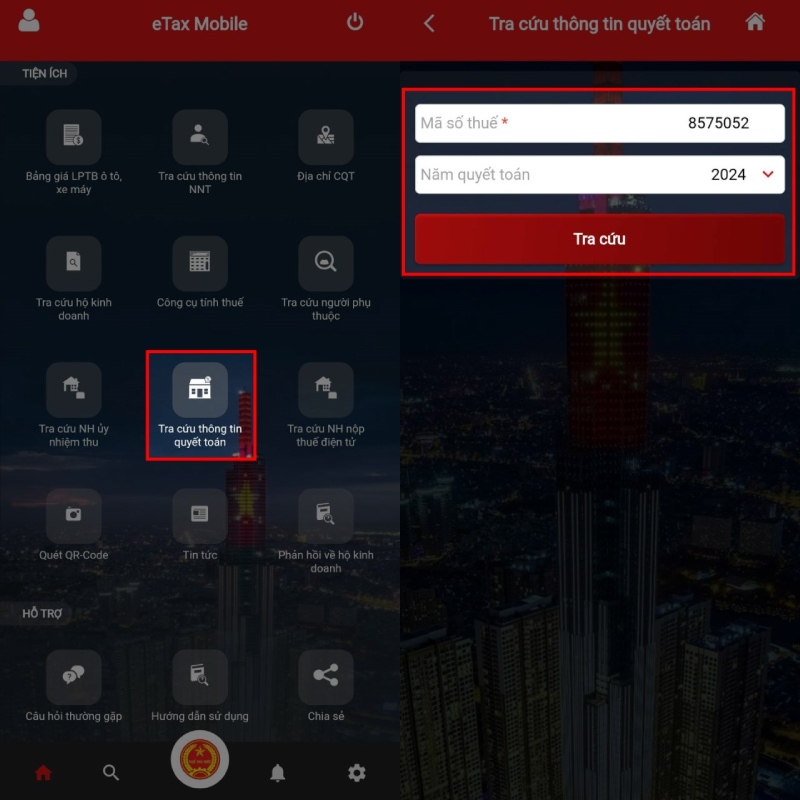

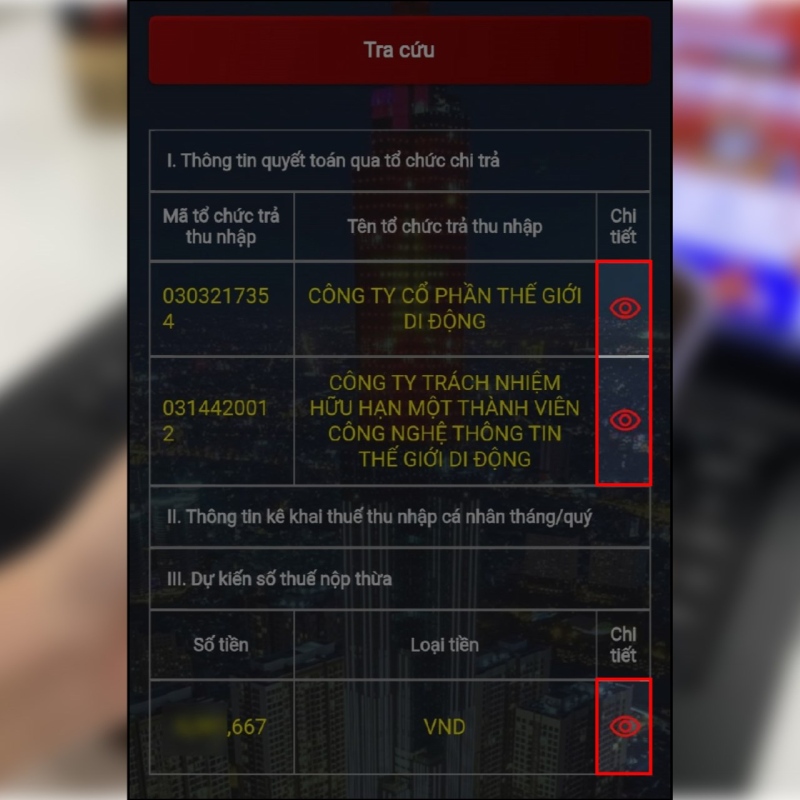

Inquire about settlement information on the main interface. Then, enter your tax code and select the settlement year.

Inquire about settlement information on the main interface. Then, enter your tax code and select the settlement year.

-

If you have overpaid taxes for the year, the application will display the estimated amount of overpaid tax along with the excess amount you have paid. In this case, you should go to the tax authority to complete the necessary procedures to receive your tax refund.

-

If you have underpaid your personal income tax, the system will display the estimated amount of tax debt along with the amount owed. You need to go to the Tax Department to complete the procedures and pay the outstanding tax to avoid penalties.

Click on the eye icon to view details.

Click on the eye icon to view details.

Checking individual tax debt is essential to ensure you fulfill your tax obligations. We hope that the information and detailed instructions provided in this article will help you easily and effectively check your tax debt.

Simple, Detailed, and Easy-to-Follow Guide on Calculating Personal Income Tax

Knowing how to calculate personal income tax will help you understand the law and fulfill your civic duty better. This is a mandatory tax for every citizen, but the amount varies depending on your wages and salary. Let’s delve into the details in the next section of the article!

The Latest VAT Refund Procedures for 2021

If you’re unsure about the value-added tax refund process, then look no further! The article below will guide you through everything you need to know.