In life, it is not uncommon to encounter land gifts even without a red book. So, what are the procedures and conditions? Join us to explore this in the article below.

1 Legal provisions on gifting land without a red book

In concept, “Gifting Land” refers to an agreement between parties where the giver transfers land use rights to the recipient without any payment obligations.

Land without a red book refers to land that has not been legally granted a land use certificate by authorized state agencies. This also implies that, in terms of legal status, the land use is not considered legitimate.

Red Book (Land Use Certificate)

Red Book (Land Use Certificate)

Typically, land-gifting transactions occur among family members with blood relations, adoptive relationships, or marital ties. In some special cases, it may involve other subjects, but it must comply with legal regulations.

The land gift can be for the entire plot or just a portion of it. If it’s a transaction for a part of the land, the land user must undergo a land division procedure.

2 Conditions for gifting land use rights

According to Article 188 of the 2013 Land Law, land gifting transactions require the land user to meet the following conditions:

Have a land use certificate (red book), except in the following cases:

Case 1: For cases where the land use right is inherited by foreigners or overseas Vietnamese who are not allowed to buy houses attached to land use rights, they will not be granted a certificate but are allowed to gift the land.

Case 2: According to Clause 1, Article 168 of the 2013 Land Law, land gifting is permitted in the following situations:

In the case of converting agricultural land use rights, the land user can gift the land after receiving a decision on land allocation or land lease.

Residential Land

Residential Land

In the case of inheriting land use rights, the land user can gift the land when the conditions for granting a certificate are met (without needing to have the certificate already).

- The land must be free from disputes.

- The land use rights must not be seized to ensure the execution of a sentence.

- The land use must be within the time limit.

3 Procedure for obtaining a red book from authorized agencies

In reality, not having a red book issued by authorized agencies as per regulations can easily lead to disputes. Therefore, to ensure ownership of the land and prevent infringement by others, land users should apply for a red book as soon as possible. This will also facilitate the process of gifting land that doesn’t have a red book yet.

Documents required:

- Land use certificate.

- Copies of ID card, household registration book, etc.

- Notarized land gift contract.

- Application form for land use certificate (according to form No. 10/ĐK issued together with Circular No. 24/2014/TT-BNTMT dated May 15, 2014)

- Other relevant documents: birth certificate, passport.

4 Implementation procedure

Step 1: Establish a notarized contract for gifting/transferring land use rights.

The contract for transferring, gifting, or inheriting land use rights must be notarized or certified by the communal-level People’s Committee.

The contract for transferring, gifting, or inheriting land must be notarized or certified by the communal-level People’s Committee.

The contract for transferring, gifting, or inheriting land must be notarized or certified by the communal-level People’s Committee.

Step 2: Register the procedure for changing the land user’s name at the land registration agency (also known as registering land use changes)

The land user submits a set of documents as mentioned above to the Land Registration Office.

The Land Registration Office will examine the documents and send land-related information to the tax agency for confirmation and notification to the land user.

Land Registration Office in District 2

Land Registration Office in District 2

Step 3: Receive the results

Within 30 days after the land user fulfills their financial obligations as per regulations, the Land Registration Office is responsible for confirming the changes in land use into the granted certificate according to the regulations of the Ministry of Natural Resources and Environment.

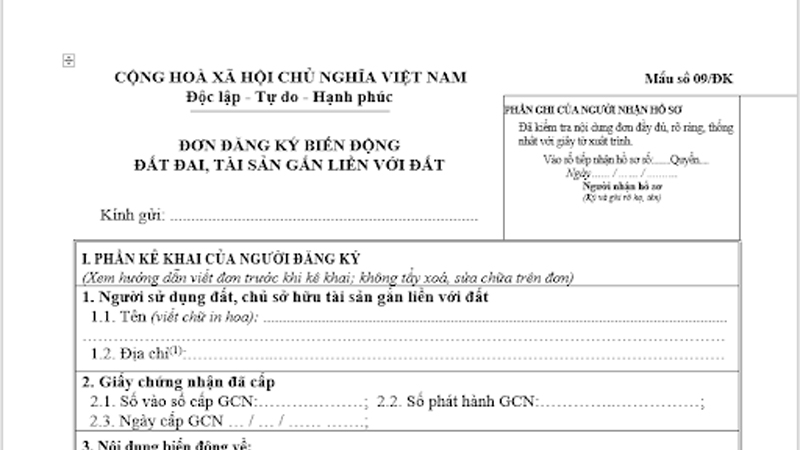

Template for Real Estate Changes

Template for Real Estate Changes

Fees for gifting land use rights

Regarding personal income tax: According to Clause 1, Article 4 of the 2007 Personal Income Tax Law (amended and supplemented in 2012), if the land use right is gifted as an inheritance or gift of real estate from family members (as defined by inheritance law), it is exempt from personal income tax.

Gifting residential land within the family with blood relations does not require the payment of registration fees.

Regarding registration fees: Gifting residential land within the family with blood relations (between husband and wife; biological parents and children, etc.) is exempt from registration fees.

For reference:

The above are essential pieces of information regarding the procedure for gifting residential land without a red book. Hopefully, this knowledge will benefit you and those around you in the future.

What is a Land Use Right Certificate (the “Red Book”) and a House Ownership Certificate (the “Pink Book”)? Everything You Need to Know About These Certificates in Vietnam.

What are the Red Book and the Pink Book? These are essential documents regarding land and property ownership in Vietnam. Understanding these documents is crucial for anyone looking to buy or sell real estate in the country. Join us as we delve into the world of the Red Book and the Pink Book and uncover everything you need to know about these vital records.