Renting a home in Vietnam as a foreigner has become increasingly popular, and understanding the procedures to register a rental property is essential. Let’s explore the latest requirements and processes for foreigners looking to rent in Vietnam.

1. Requirements for Foreigners Renting in Vietnam

According to Article 119 of the 2014 Housing Law, both landlords and tenants must meet specific criteria to enter into a rental agreement.

Landlord Requirements

The landlord must be the legal owner of the property or have authorization from the owner to conduct the transaction as per legal regulations. They must also possess full civil act capacity. If the landlord is an organization, it must have legal personality and a business license, unless the property is a charitable house donated by the organization.

Tenant Requirements

The tenant must be a foreign individual with full civil act capacity. They should also fall under the category of those eligible to own houses in Vietnam, although they are not required to have temporary or permanent residence registration at the place of the transaction.

As per Article 118 of the 2014 Housing Law, the rented property must meet the following criteria:

- It must have a Certificate of House Ownership that is legally recognized.

- The rented property must not be subject to any disputes, complaints, or temporary ownership issues.

- It should not be under any enforcement actions, such as being seized to execute a court decision or administrative decision of a competent state agency.

- The property must not be subject to land recovery, eviction notices, or house demolition orders by competent authorities.

- The landlord must ensure the rental property meets quality standards, including functional electricity and water systems, environmental hygiene, and safety for the tenant.

For further reference: These

2. Registration Procedures for Renting to Foreigners

To register a rental property for foreigners, landlords need to follow these steps:

Step 1 Register for Business Operations in Rental Services

Landlords should visit the People’s Committee of the locality where the rental property is located to register for business operations. They need to bring relevant documents such as the red book (land use right certificate), personal papers, etc.

Step 2 Pay Business Taxes and Declare the Rental Apartment Tax Code

Landlords are required to pay business taxes and declare the rental apartment tax code to the relevant authorities to monitor their business activities.

The necessary documents for this step include:

- Business registration certificate.

- Business tax declaration form.

- Local rental apartment tax code declaration form.

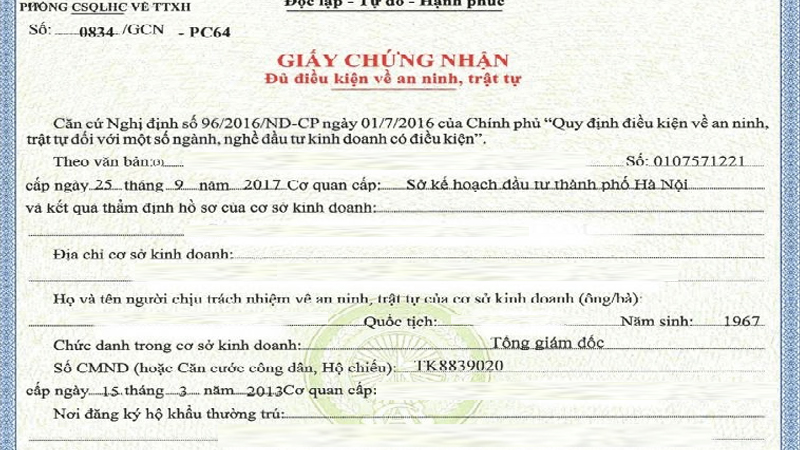

Step 3 Register for Local Security and Order

Registering with the local security and order authority helps the local management agency control residence, safety, and security for the tenant and the rental area.

Documents required by the landlord for this step:

- Business registration certificate.

- Household owner’s personal history form.

- Application for security and order certification to operate the rental business.

- Fire prevention and control eligibility certificate.

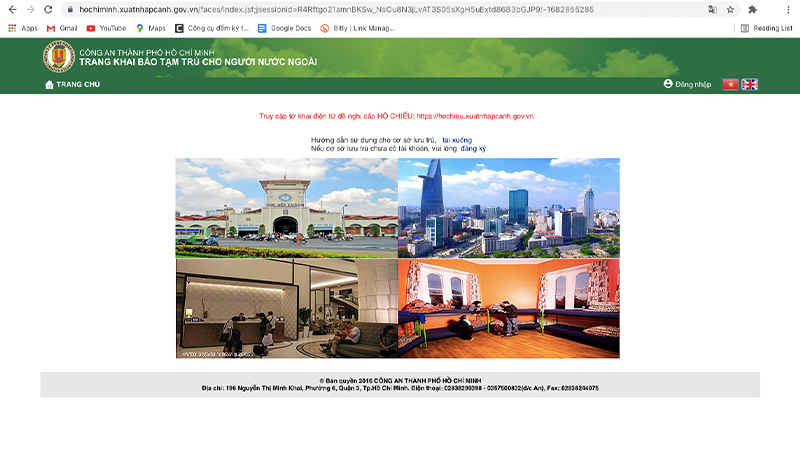

Step 4 Temporary Residence Registration for Foreign Tenants at the Local Police Station

Accurate temporary residence registration for foreign tenants is crucial to help authorities quickly verify and proactively handle any issues that may arise.

The required documents for this step include:

- Business license.

- Temporary residence registration form for foreigners.

- Valid foreign passport with a Vietnamese visa or residence permit.

- Rental agreement.

- Security and order certificate issued by the district police.

- Certificate of ownership and other personal papers.

Step 5 Fulfill Personal Income Tax Obligations

Finally, to conclude the rental process, landlords need to pay personal income tax at the local tax department.

Documents required by the landlord for this step include:

- Rental agreement.

- Tax declaration form submitted to the tax authority.

- Confirmation of personal income tax payment to be submitted to the State Treasury.

3. Important Notes for Landlords Renting to Foreigners

Here are some essential notes for landlords when renting to foreigners:

– First, landlords must provide documentation proving their legal ownership of the rental property. Specifically:

- If the rental property is your house, you must have a Certificate of Land Use Right, Ownership of Houses, and Other Land-attached Assets.

- If you are renting out a property that you are leasing from the legal land user, your lease agreement with the owner must include the right to sublet.

– Second, regarding the Rental Agreement:

According to the 2015 Civil Code and the 2014 Housing Law, the rental agreement between the parties must be in writing and include the following contents:

- Full names and addresses of the parties.

- Description of the house and the land lot attached to it.

- Rental price.

- Payment terms and timeline.

- Timeline for handing over the house and the rental period.

- Rights and obligations of the parties.

- Commitments of the parties.

- Other agreements, if any.

- Effective date of the contract.

- Date, month, and year of signing the contract.

- Signatures and full names of the parties.

Additionally, this agreement only needs to be signed by the parties to take effect and does not require notarization or authentication.

The above information outlines the latest procedures for registering a rental property for foreigners in Vietnam. We hope you find this information useful. Stay healthy!

For further reading: