Legal procedures can be daunting for citizens and businesses, and understanding the intricacies of the process is essential to save time and effort. Today, we delve into the complex process of temporarily suspending a business’s operations, as outlined on https://www.bachhoaxanh.com/.

1 Preparing Documents for Temporary Business Suspension

To initiate the temporary suspension of business operations, the representative of the agency, company, or business entity must compile the following documents:

– Notification of Temporary Business Suspension (as per Appendix II-21 in Circular No. 02/2019);

– Decisions and official copies of meeting minutes from the relevant governing body, such as the Members’ Council for a multi-member limited liability company, the company owner for a single-member LLC, the Board of Directors for a joint-stock company, or the partners for a partnership;

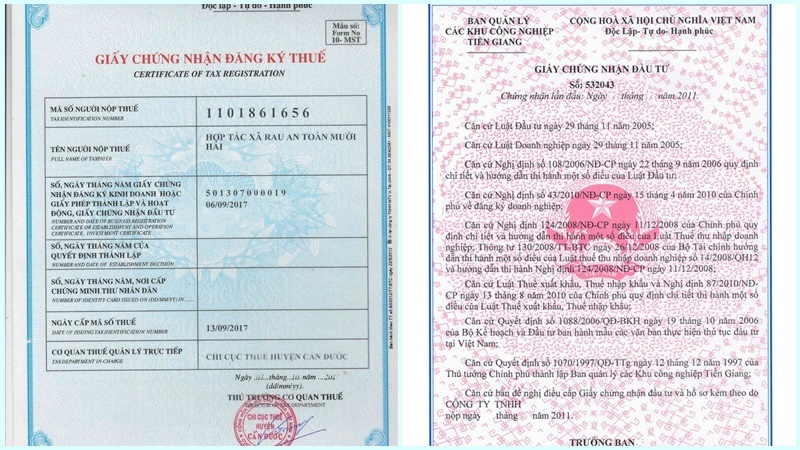

– Enterprises with an Investment Certificate, Investment Registration Certificate, or equivalent legal documents must also submit legitimate copies of these certificates, along with a proposal for supplementing and updating enterprise registration information (Appendix II-18, Circular No. 02/2019).

Tax Registration and Investment Certificates

Tax Registration and Investment Certificates

2 Procedure for Temporary Business Suspension

Procedure Outline

Procedure Outline

According to Clause 1, Article 200 of the Enterprise Law No. 68/2014/QH12 (https://luatvietnam.vn/doanh-nghiep/luat-doanh-nghiep-2014-91359-d1.html), businesses must notify the managing authority at least 15 days before temporarily suspending operations. Here’s a step-by-step guide to the process:

Before approaching the state agency, the individual or organizational representative must draft documents adhering to regulations. This includes stating the reason for the temporary suspension, such as financial difficulties or renovations.

Once the required documents are ready, the individual, organizational representative, agency, or business entity will submit them to the Planning and Investment Department of the province/city where the head office is located.

Upon receiving the documents, the Business Registration Office will seek input from relevant agencies, if necessary. They will then process the request and update the status of the documents in the online database for the enterprise to track.

After processing the documents, the state agency will inform the enterprise of the legality of the documents and the outcome of the temporary suspension request. The enterprise must then submit the documents to the registration authority if the submission was made online.

Once the enterprise receives notification of the temporary suspension, it can halt operations for the specified period. Only after this period has elapsed can the enterprise resume activities or request an earlier restart.

Further Reference:

3 Sample Documents for Temporary Business Suspension

Documents for Temporary Suspension for Different Business Types

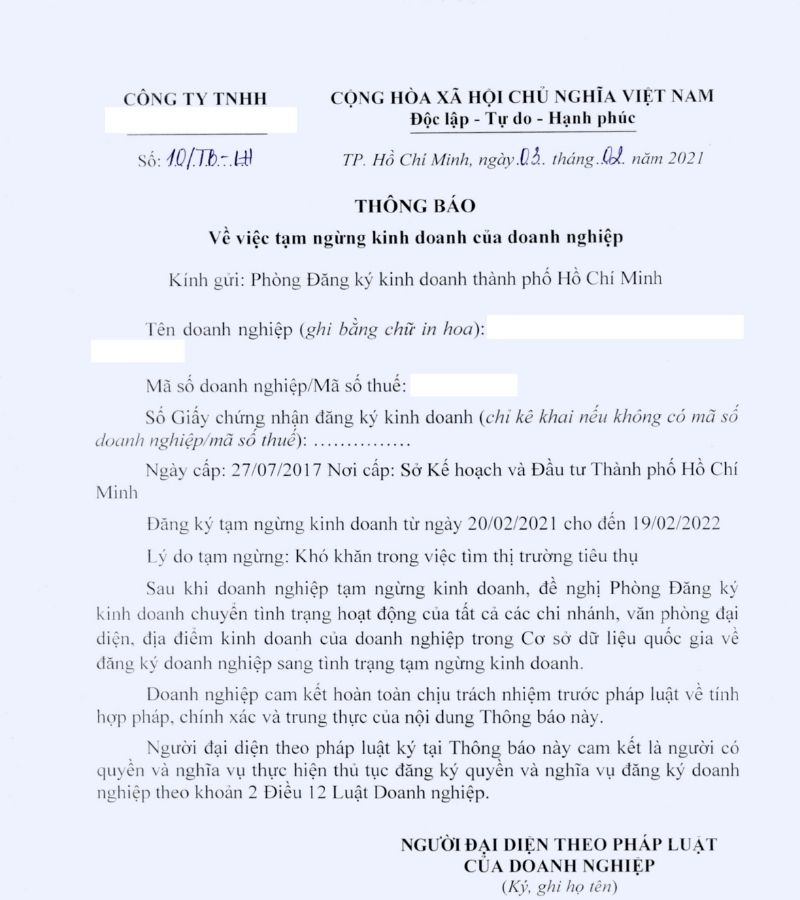

Documents for Limited Liability Companies

Documents for Limited Liability Companies

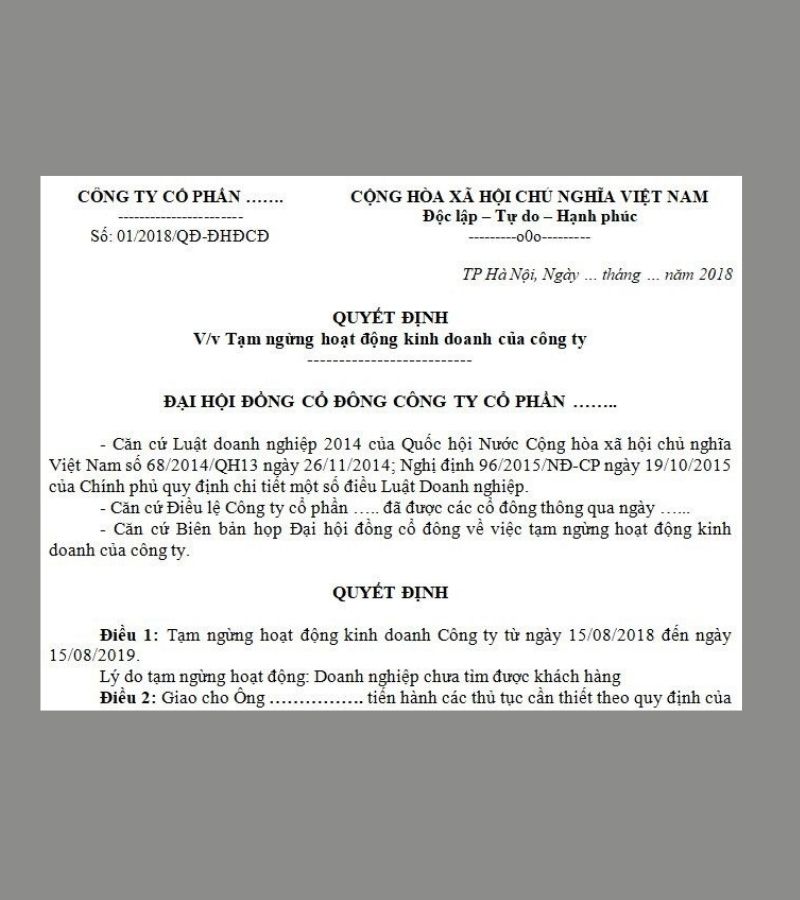

Documents for Joint-Stock Companies

Documents for Joint-Stock Companies

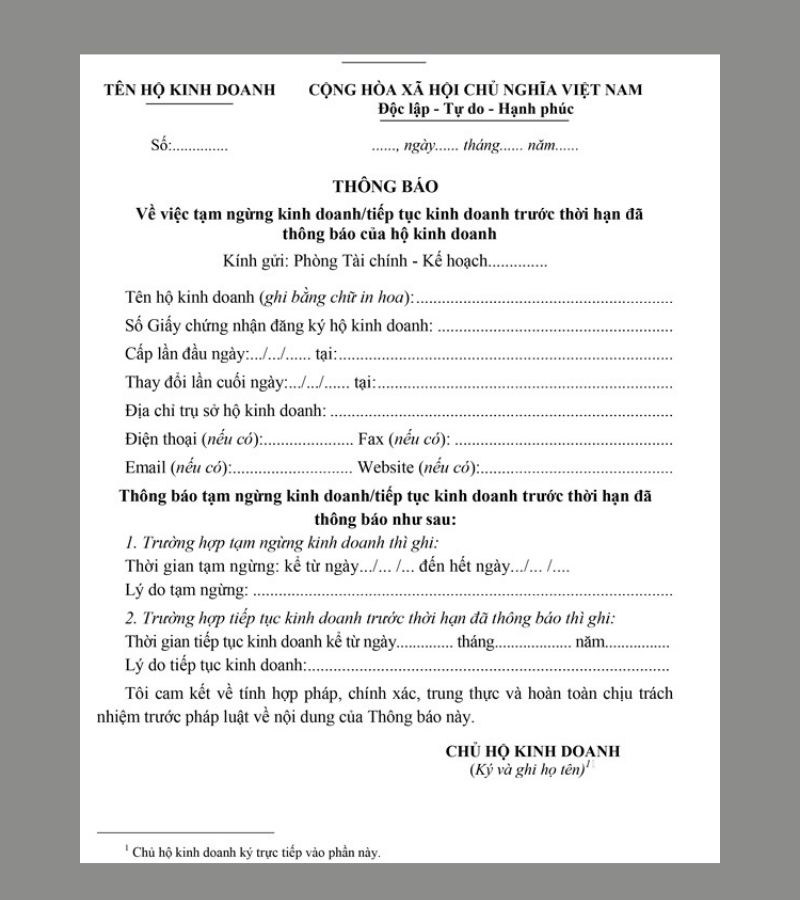

Documents for Household Businesses

Documents for Household Businesses

4 Permitted Duration of Temporary Business Suspension

After completing the procedure with the state agency, businesses are allowed to suspend operations for up to one year. If an extension is needed, they must notify the Business Registration Office. It’s important to note that consecutive temporary suspensions should not exceed two years in total.

Temporarily Closed Store

Temporarily Closed Store

5 Temporary Business Suspension and Tax Matters

Tax Authority Considerations

Businesses that temporarily suspend operations are not required to submit suspension-related documents to the tax authority. This is handled by the Business Registration Office. Before the suspension takes effect, all tax debts and declarations for the quarter, month, etc., must be settled.

Tax Authority Matters

Tax Authority Matters

Timeline for Document Resolution

Within three days of receiving the documents, the Business Registration Office will acknowledge receipt to the enterprise. If the documents are in order, they will notify the enterprise of the temporary suspension result. For online submissions, once notified of compliance, the enterprise representative must submit hard copies of the documents to the Business Registration Office to receive the outcome.

If the documents are found to be invalid, the Business Registration Office will specify the necessary corrections. The enterprise must then resubmit the documents, following the previous steps. Note that the timeline for notification is three days, excluding holidays.

Relevant Forms

Sample Notification of Temporary Business Suspension

Sample Decision on Temporary Business Suspension

6 Frequently Asked Questions about Temporary Business Suspension Procedures

FAQs

FAQs

How to Submit Documents for Temporary Business Suspension

Documents can be submitted directly or online. Method 1 involves submitting documents to the Business Registration Office under the Department of Planning and Investment of the province or city where the enterprise is headquartered. Method 2 is the online route, which involves four steps: registering an account on the National Portal on Business Registration, entering data, scanning and attaching documents, and confirming submission.

Timeline for Notifying Temporary Business Suspension

For enterprises: No longer than one year. Extensions beyond this require notification to the Business Registration Office (per Clause 1, Article 66 of Decree 01/2021/ND-CP). *For business households: Indefinite suspension is allowed (Clause 1, Article 91 of Decree 01/2021).

Penalties for Failing to Notify Temporary Business Suspension

| Fine | Additional Penalty | Legal Basis | |

| Enterprises | – Failure to notify or delayed notification: 01 – 02 million VND. – Notifying temporary suspension of operations without including branches, representative offices, and business locations: 01 – 02 million VND. | The Enterprise Law Certificate will be revoked for temporary suspension of operations exceeding one year. | Article 32 of Decree 50/2016/ND-CP |

| Business Households | – Temporary suspension without notification or delayed notification (less than 6 months): 500,000 – 1 million VND. – Cessation of operations for over 6 consecutive months without notification: 01 – 02 million VND. | Forced to send a notification to the business registration authority. | Article 42 of Decree 50/2016/ND-CP |

Further Reference:

We hope this article has shed light on the process of temporarily suspending business operations. Feel free to reach out with any further questions!

Related Articles:

What Are the Essential Reasons to Go Out and Which Documents to Bring?

“As Ho Chi Minh City implements social distancing measures, it’s important to know when it is essential to go out and what documents you need to carry. Join us as we explore this pressing matter and provide you with the information you need to stay safe and informed during these unprecedented times.”