When signing an employment contract, employees who are subject to personal income tax must not only fulfill their tax obligations but also know that if they overpay their taxes, the excess will be carried over to the next period or they can request a refund if they meet certain conditions. We will guide you through the steps to apply for a personal income tax refund in a simple and detailed manner.

1 What is a Personal Income Tax Refund?

A personal income tax refund is the process by which the tax authority refunds a portion of an individual’s paid taxes if that individual meets the conditions stipulated by law.

A personal income tax refund is the process by which the tax authority refunds a portion of an individual’s paid taxes if that individual meets the conditions stipulated by law.

A personal income tax refund is the process of the tax authority refunding an individual’s overpaid taxes if that person meets the eligibility criteria as per the law.

2 Eligibility for a Personal Income Tax Refund

As per Article 23 of Circular No. 92/2015/TT-BTC (amending and supplementing Article 53 of Circular No. 156/2013/TT-BTC), the conditions for a personal income tax refund are as follows:

Personal income tax refunds are only applicable to those with a tax code.

Personal income tax refunds are only applicable to those with a tax code.

- Personal income tax refunds are only applicable to individuals with a valid tax code at the time of the refund request.

- If an individual has authorized an organization, the refund will be processed through that organization.

- If an individual has not authorized any organization, they must directly declare their income to the tax authority or carry forward the overpayment to the next period.

3 Procedures for a Personal Income Tax Refund with an Authorized Enterprise

- Application for refund of state budget revenue (Form No. 01/DNHT issued together with Circular No. 156/2013/TT-BTC).

- Copies of tax payment vouchers and personal income tax returns, with the signature of the authorized representative of the organization or individual paying the income.

- Power of attorney for tax finalization (Form 02/UQ-QTT-TNCN).

Check that all documents are complete and submit them to the directly managing tax authority.

Within six working days of receiving the complete and valid refund application, the head of the tax authority will issue a notification of transfer to the pre-inspection and refund process, as per (Point a, Clause 3, Article 58 of Circular No. 156/2013/TT-BTC).

4 Procedures for a Personal Income Tax Refund with an Individual Self-Finalization

Individual Submitting Directly to the Tax Authority

- Tax finalization declaration Form No. 02/QTT-TNCN.

- Form No. 02-1BK-QTT-TNCN

- Personal income tax withholding vouchers (provided by the enterprise)

- Identity card (ID card)

- Copy of the labor contract (if finalizing taxes at the tax authority managing the enterprise for family dependents)

- Or household registration book/temporary residence book (if finalizing taxes at the individual’s place of residence)

Individuals should submit their documents directly to the Tax Department where they filed their tax returns during the year.

- When documents are submitted directly to the tax authority, a tax official will receive and stamp the receipt, recording the time of receipt, the number of documents in the file, and entering the information into the tax authority’s logbook.

- If the documents are sent by postal service, the tax official will stamp the date of receipt and enter the information into the tax authority’s logbook.

- Within six working days, the Tax Department will send a notification to transfer the file to the pre-inspection and refund process, as per the law.

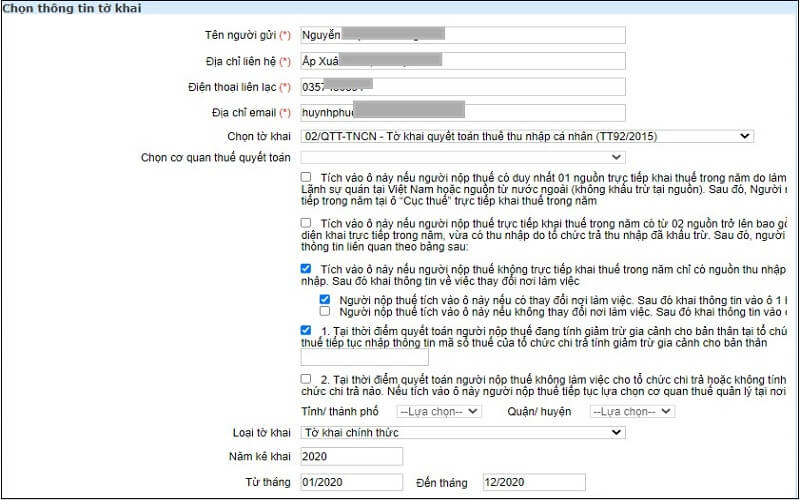

Individual Submitting Online via Website

Declare directly on the websites canhan.gdt.gov.vn or thuedientu.gdt.gov.vn.

Declare directly on the websites canhan.gdt.gov.vn or thuedientu.gdt.gov.vn.

Complete the Tax Finalization Declaration Form No. 02/QTT-TNCN on the HTKK or HTKT TCNC v3.3.2 software and export it as an XML file. Alternatively, you can declare directly on the websites https://canhan.gdt.gov.vn or http://thuedientu.gdt.gov.vn by logging in, providing the necessary information, and submitting the declaration.

Once the Tax Finalization Declaration Form No. 02/QTT-TNCN is completed, submit it through the websites canhan.gdt.gov.vn or thuedientu.gdt.gov.vn.

Complete the necessary information and click to submit the application.

Complete the necessary information and click to submit the application.

If declaring directly on the websites canhan.gdt.gov.vn or thuedientu.gdt.gov.vn, after providing all the necessary information and completing the tax finalization declaration, check the box “I declare that the data provided and the attached documents are true and accurate, and I take responsibility for them under the law.” Then, review the information and click to submit the application.

Upon receiving the online refund request, the tax authority will process it within six working days.

5 Timeframe for a Personal Income Tax Refund

Depending on the type of application, the time to process the personal income tax refund ranges from 6 to 45 days.

Depending on the type of application, the time to process the personal income tax refund ranges from 6 to 45 days.

According to Article 58 of Circular No. 156/2013/TT-BTC, the time limit for processing a personal income tax refund is clearly specified as follows:

- For personal income tax refund applications that are eligible for a refund before inspection, the tax authority will process them within a maximum of six working days from the date of receiving the application.

- For personal income tax refund applications that require pre-inspection, the tax authority will process them within a maximum of 40 working days from the date of receiving the application.

6 Notes on the Personal Income Tax Refund Process

Having a Personal Taxpayer Electronic Transaction Account is Essential

A Personal Taxpayer Electronic Transaction Account is crucial for online tax declaration.

A Personal Taxpayer Electronic Transaction Account is crucial for online tax declaration.

A Personal Taxpayer Electronic Transaction Account is necessary for online tax declaration. You can register for this account in four ways: by visiting the tax authority, through the National Public Service Portal, through the Vietnam Electronic Tax Portal, or via the HCM Tax mobile application.

Completing the Tax Finalization Declaration Form 02/QTT-TNCN is Mandatory

Individuals who wish to submit refund requests directly must do so using an Excel file.

Individuals who wish to submit refund requests directly must do so using an Excel file.

The Tax Finalization Declaration Form 02/QTT-TNCN is an essential document in the tax finalization process. Individuals who wish to submit refund requests directly must complete this form themselves or use applications like HTKK or HTKT TCNC v3.3.2 to submit it online in XML format, or they can submit it directly to the tax authority using an Excel file.

The above information provides the latest guidelines on the personal income tax refund process, and we hope it will be helpful and interesting to you.

The fastest and most accurate guide to look up online business licenses that not everyone knows

Verifying and checking business licenses is a crucial step in ensuring the accuracy and legitimacy of business information. This can be done through the National Information Portal or the Tax Department’s website. By searching for business licenses, businesses can ensure their compliance with regulations and establish a solid foundation for growth.