If you’ve recently purchased a car, the next step is to register it and pay the vehicle registration tax. However, not everyone knows the procedure for paying this tax. So, we are here to guide you through the process of paying the vehicle registration tax for new and used cars in 2021 in this article.

1 Deadline for Paying the Vehicle Registration Tax

According to Clause 8, Article 18 of Decree No. 126/2020/ND-CP, you have 30 days to pay the vehicle registration tax from the date of issuance of the notification. If you miss the deadline, you will be charged a late payment fee of 0.05%/day of the overdue amount.

Deadline for paying the vehicle registration tax

Deadline for paying the vehicle registration tax

Although the regulations are not entirely consistent, it is advisable to declare and pay the tax (within 30 days from the date of the car purchase or transfer contract) to complete the vehicle registration process.

2 Vehicle Registration Tax for New Cars

How to calculate the vehicle registration tax for new cars

How to calculate the vehicle registration tax for new cars

According to Article 5 of Decree No. 140/2016/ND-CP, the vehicle registration tax for new cars is calculated as follows: Vehicle Registration Tax = Taxable Value x Tax Rate (%).

As mentioned in the formula, to calculate the tax amount, you need to know the taxable value and the tax rate, specifically:

To find out the taxable value for each type of vehicle, you can refer to the following decisions: Decision No. 618/QD-BTC dated April 9, 2019, as amended and adjusted by Decision No. 1112/QD-BTC dated June 28, 2019, Decision No. 2064/QD-BTC dated October 25, 2019, Decision No. 452/QD-BTC dated March 31, 2020, and Decision No. 1238/QD-BTC dated August 21, 2020.

Note: The taxable value may be lower than the listed price.

Clause 5, Article 7 of Decree No. 140/2016/ND-CP, as amended and supplemented by Point a, Clause 2, Article 1 of Decree No. 20/2019/ND-CP, stipulates the tax rates for different types of vehicles as follows:

Different tax rates for different types of vehicles

Different tax rates for different types of vehicles

- 2% for cars, trailers or semi-trailers pulled by cars, and similar vehicles.

- 10% for cars with 9 seats or less (refer to the resolutions of each province/city for specific rates).

Note: The People’s Council of each province/city can adjust the rate to suit local conditions, but the maximum rate should not exceed 15%.

- For cars that can carry both passengers and goods (pick-up trucks) with a permitted loading capacity of less than 1,500 kg and with 5 seats or less, the tax rate is 60% of the rate for cars with 9 seats or less.

- For cars with 9 seats or less, cars that can carry both passengers and goods (pick-up trucks) with a permitted loading capacity of less than 1,500 kg and with 5 seats or less, and vans with a permitted loading capacity of less than 1,500 kg, the tax rate for the second and subsequent registrations is 2% and is uniform across the country.

- The maximum vehicle registration tax is VND 500 million/car/registration, except for cars with 9 seats or less.

3 Vehicle Registration Tax for Used Cars

How to calculate the vehicle registration tax for used cars

How to calculate the vehicle registration tax for used cars

According to Article 5 of Decree No. 140/2016/ND-CP and Point a, Clause 2, Article 1 of Decree No. 20/2019/ND-CP, the vehicle registration tax for used cars is calculated using the following formula:

Vehicle Registration Tax = Taxable Value x 2%.

To find the taxable value for a used car, you need to know the taxable value when the car was new and then multiply it by the remaining quality percentage using the following formula:

Taxable Value (remaining value) = New Asset Value x Remaining Quality Percentage

The remaining quality percentage is determined based on the age of the vehicle as follows:

- 90% for vehicles that have been used for less than 1 year.

- 70% for vehicles that have been used for 1 to 3 years.

- 50% for vehicles that have been used for 3 to 6 years.

- 30% for vehicles that have been used for 6 to 10 years.

- 20% for vehicles that have been used for more than 10 years.

The new asset value (initial taxable value) can be found in the list published by the Ministry of Finance (in the decisions mentioned above).

4 Procedure for Paying the Vehicle Registration Tax

According to Official Dispatch No. 3027/TCT-DNNCN dated July 29, 2020, of the General Department of Taxation on expanding the implementation of electronic payment of vehicle registration tax and exchanging electronic data on vehicle registration tax payment, the procedure for paying the tax is as follows:

Implementation Conditions

To pay the vehicle registration tax electronically, the taxpayer must meet one of the following two conditions:

-

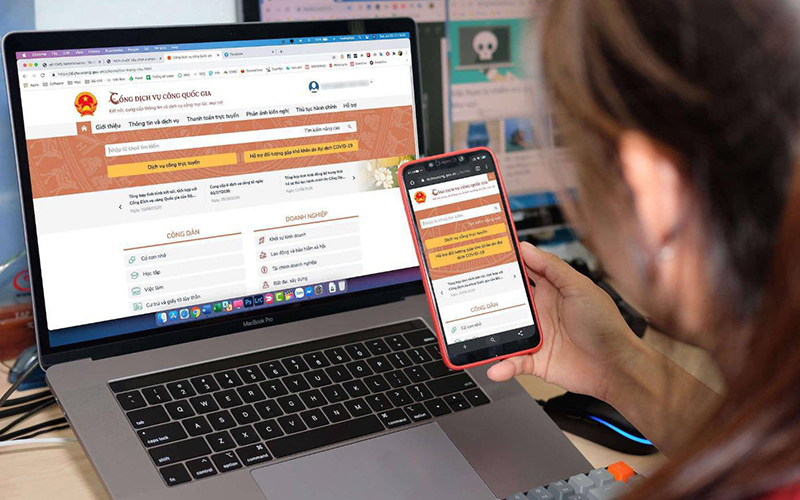

Have an account registered on the National Public Service Portal that is linked to a bank account. In this case, the taxpayer can pay the vehicle registration tax through the National Public Service Portal.

Paying the vehicle registration tax through the National Public Service Portal

Paying the vehicle registration tax through the National Public Service Portal

Note: The payment can be made from the account of the taxpayer (vehicle owner) or on their behalf through the account of another individual registered on the National Public Service Portal.

-

Have an account registered for electronic payment services (Internet Banking) at one of the following banks: Vietcombank, Vietinbank, Agribank, VPBank, MBBank, TPBank, or BIDV. The taxpayer can then pay the vehicle registration tax through these banks.

Instructions for Declaring and Paying the Vehicle Registration Tax Electronically

Paying the vehicle registration tax electronically

Paying the vehicle registration tax electronically

Step 1: Declare the Vehicle Registration Tax

The taxpayer can choose to declare the tax according to one of the following two methods:

Method 1: Declare directly at the tax authority.

Method 2: Declare electronically through the National Public Service Portal or the portal of the General Department of Taxation.

Step 2: Pay the Tax

The taxpayer can access the National Public Service Portal or the electronic payment channel of a commercial bank to pay the vehicle registration tax.

Step 3: Receive a Text Message from the General Department of Taxation to Proceed with Vehicle Registration

5 Cases of Exemption from the Vehicle Registration Tax

According to Article 9 of Decree No. 140/2016/ND-CP and Points c and d, Clause 3, Article 1 of Decree No. 20/2019/ND-CP, vehicles in the following cases are exempt from the vehicle registration tax:

Vehicles owned by foreign organizations or individuals, including:

-

Diplomatic missions, consular offices, and representative offices of international organizations of the United Nations system.

-

Diplomatic, consular, administrative, and technical staff of diplomatic missions, consular offices, and representative offices of international organizations of the United Nations system, as well as their family members who are not Vietnamese citizens or permanent residents in Vietnam and hold diplomatic or official identification cards issued by the Vietnamese Ministry of Foreign Affairs.

-

Foreign organizations or individuals not mentioned in Points a and b but are exempt or not subject to the vehicle registration tax according to international commitments to which the Socialist Republic of Vietnam is a member.

Vehicles of foreign organizations or individuals exempt from the vehicle registration tax

Vehicles of foreign organizations or individuals exempt from the vehicle registration tax

Vehicles that are leased and transferred to the lessee at the end of the lease term are exempt from the vehicle registration tax when the lessee purchases the vehicle.

In cases where a financial leasing company buys a vehicle from a unit that has already paid the vehicle registration tax and then leases it back to that unit, the financial leasing company is exempt from paying the vehicle registration tax.

Vehicles that have been issued a vehicle registration certificate and are registered again are exempt from the vehicle registration tax in the following cases:

-

Vehicles that have been issued a certificate of ownership or use by the competent authorities of the Democratic Republic of Vietnam, the Provisional Revolutionary Government of the Republic of South Vietnam, the Socialist Republic of Vietnam, or the former regime, and are now issued a new vehicle registration certificate without changing the vehicle owner.

-

Vehicles of state-owned enterprises and public non-production units that have been equitized into joint-stock companies or rearranged according to the law.

-

Vehicles that have been issued a vehicle registration certificate in the name of a household and are now registered in the name of household members due to division according to the law.

-

Vehicles that have been issued a vehicle registration certificate and are now issued a new certificate due to loss, damage, fading, or deterioration of the old certificate.

Fire trucks, ambulances, garbage trucks, and other specialized vehicles are exempt from the vehicle registration tax.

Fire trucks, ambulances, garbage trucks, and other specialized vehicles are exempt from the vehicle registration tax.

Vehicles that have already paid the vehicle registration tax (except for those exempt from the tax) and are transferred to another organization or individual for ownership registration are exempt from the tax in the following cases:

-

Vehicles contributed by organizations, individuals, or cooperative members as capital to enterprises, credit institutions, or cooperatives, or when enterprises, credit institutions, or cooperatives are dissolved or divided, or when capital is withdrawn by organizational or individual members who had previously contributed the vehicles.

-

Vehicles transferred within an enterprise or within a state administrative or non-business unit according to the decision of the competent authority.

-

Vehicles that have already paid the vehicle registration tax and