A Guide to Personal Income Tax Calculation for 2025

According to the provisions on taxable income under Article 3 of the 2007 Personal Income Tax Law, as amended by the 2012 Amended Personal Income Tax Law, the 2014 Law Amending Tax Laws, and other relevant laws, individuals receiving taxable income into their personal accounts are subject to personal income tax.

Below is a guide on how to calculate Personal Income Tax for 2025

For income from business activities, the following sectors are considered:

– Income from the production and trading of goods and services across all sectors and industries as stipulated by law, including: production and trading of goods; construction; transportation; catering services; and other services such as leasing of houses, land use rights, and other assets.

– Income from freelance activities in fields and industries that require licenses or practice certificates as prescribed by law.

– Income from agricultural, forestry, salt production, aquaculture, and fishing activities that do not meet the conditions for tax exemption as specified in Point e, Clause 1, Article 3 of Circular No. 111/2013/TT-BTC.

How to Calculate Personal Income Tax for Business Activities

Personal Income Tax = Taxable Revenue x Personal Income Tax Rate

Where:

– Taxable revenue for business households and individuals includes taxes (for taxable activities) on total sales, processing fees, commissions, and service provision revenue generated during the tax period from production and business activities in the fields of goods, services, including bonuses, sales support, promotions, trade discounts, payment discounts, non-monetary support; subsidies, surcharges, additional fees received as stipulated; compensation for breach of contract, other compensations (only counted as taxable revenue); and other revenues that business households and individuals are entitled to, regardless of whether the money has been collected.

As for the personal income tax rate, it varies from 0.5% to 5% depending on the sector. Specifically, for services such as catering, accommodation, and repairs, a 2% tax rate is applied. For the trading of goods (buy and sell), retail sales including bonuses, commissions, and discounts when distributing and supplying goods that are not subject to value-added tax or subject to 0% value-added tax or not subject to value-added tax declaration, a 0.5% tax rate is applied. For construction, transportation, and production sectors, the tax rate is 1%. For insurance agency, lottery agency, multi-level sales, compensation for breach of contract, and other compensation, a 5% tax rate is applied for leasing assets (houses, land, shops, warehouses, factories, machinery…)

For business households with an annual revenue of over 100 million VND, there is an obligation to pay taxes. If the revenue is below this threshold, they are completely exempt from both value-added tax and personal income tax.

In the case of large-scale business households that employ many laborers or have a registered business form under a contract (such as car rental services, project execution, and regular invoice issuance), they will have to pay taxes according to the declaration method. In this case, the taxable income is determined by revenue minus reasonable and lawful expenses, and the taxable income will be calculated according to the progressive tax rate table, similar to salaried employees.

Calculating personal income tax for business households is often simpler than for employees because it only involves multiplying the revenue by a fixed tax rate. However, to ensure fairness and accuracy in taxation, business households should coordinate with local tax authorities to declare revenue and business fields transparently from the beginning of the year.

Timing of Determining Taxable Revenue

For taxable revenue under the allocation method, the time for individuals to determine revenue is from November 20 to December 15 of the year before the tax year.

For business individuals who are new to business (not operating from the beginning of the year) or who change their business scale and industry during the year, the time to determine taxable revenue for the year is within 10 days from the date of commencement of business or the date of change of business scale and industry.

For business households that calculate taxes based on invoices, the time to determine revenue is at the time of delivery of goods, completion of services, or acceptance/handover of works.

Methods for Calculating Taxes for Business Households

Depending on the scale, field, and industry, business households and individuals will apply different methods for calculating taxes, including:

Declaration Method: Applied to large-scale business households and individuals or those that have not yet reached a large scale but choose the declaration method.

– Advantages: Suitable for professional business households or small and medium-sized enterprises, the declaration method helps taxpayers accurately determine taxable income and deduct reasonable and legitimate expenses, reducing tax obligations during difficult business periods or losses. Transparent tax management also facilitates expansion, collaboration with banks and partners, or participation in tenders.

– Disadvantages: It requires taxpayers to have a clear accounting system, complete invoices and vouchers, and tight control over cash flow, which can be challenging for small businesses lacking accounting experience. Regular declaration, finalization, and reporting procedures can also create time and personnel pressures, especially for those without financial expertise.

Tax Declaration Method for Each Occurrence: Applied to individuals and business households that operate irregularly, without a fixed business location, and with tax declaration obligations for each transaction, not on a monthly or quarterly basis.

– Advantages: Suitable for individuals with irregular income such as short-term property leasing, real estate sales, one-time income from services or project contracts. Taxpayers only need to declare and pay taxes when income arises, without the need for monthly or quarterly declarations.

– Disadvantages: Due to the absence of a fixed declaration schedule, individuals must independently monitor and fulfill their obligations on time, which can lead to errors or omissions, resulting in administrative penalties for tax violations. Additionally, a lack of understanding of the regulations may cause individuals to overlook or misdeclare information.

Allocation Method: Business households and individuals who do not fall under the declaration method or the method of declaration for each occurrence will pay taxes according to the allocation method.

– Advantages: This is a simple and popular method for small-scale businesses and traders. Taxpayers do not need to declare monthly, keep accounting books or invoices, and only need to pay a fixed amount of tax based on the quarterly tax base. It is suitable for individuals with stable and unchanged business activities.

– Disadvantages: As the tax calculation is primarily based on estimates, there may be cases where the calculated amount is higher than the actual situation, causing losses to the business. Additionally, the allocation method may lead to an overestimation of revenue compared to reality. Moreover, the lack of invoices and accounting books makes it challenging to prove profits and losses in business activities.

Note:

Business households with revenue of 1 billion VND or more that are currently using the allocation method will have to switch to the declaration method.

Business households with revenue below 1 billion VND can choose to pay taxes according to one of the following two methods from now until December 31, 2025:

– Allocation method.

– Declaration method.

This includes salary, bonus, and allowances with the nature of salary (except for tax-exempt amounts such as hazardous work allowances, maternity benefits, and unemployment benefits).

Before calculating personal income tax, it is essential to determine whether you are a resident or non-resident individual and whether your labor contract is for more or less than three months to accurately calculate your personal income tax.

There are two ways to calculate personal income tax based on the duration of the labor contract:

– Labor contracts of three months or more: calculated according to the progressive tax rate table.

– Labor contracts of less than three months and without a labor contract: calculated at a tax rate of 10%.

Here is how to calculate personal income tax for employees with labor contracts of three months or more:

For cases where personal income tax is calculated according to the progressive rate table, the formula is as follows:

Personal Income Tax = Taxable Income x Tax Rate

Where:

Taxable income is calculated as follows:

Taxable Income = Total Income – Tax-Exempt Amounts – Deductions

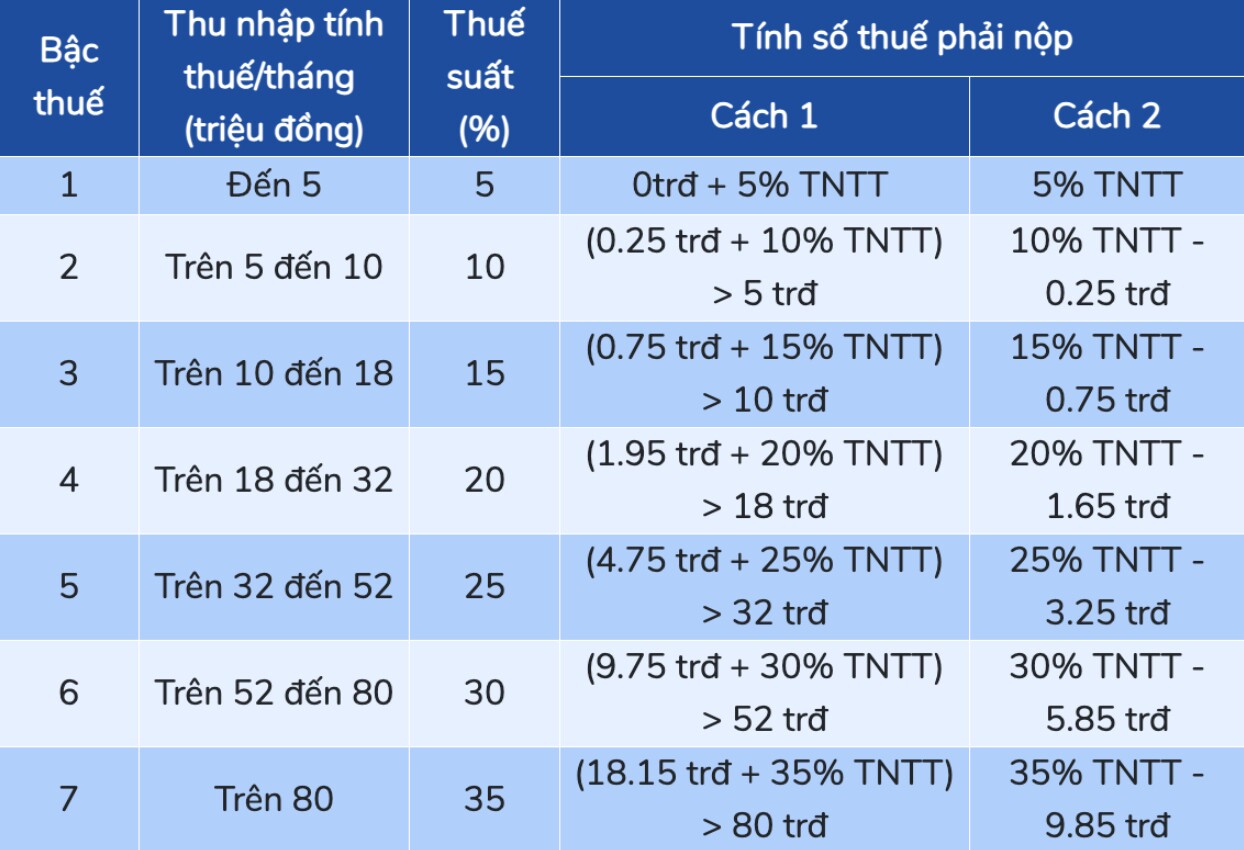

The progressive tax rate table is as follows:

In addition, individuals can calculate personal income tax according to the simplified progressive tax rate table in Appendix 01/PL-TNCN issued together with Circular No. 111/2013/TT-BTC:

Note: The following income items are exempt from personal income tax if the employee has worked for the company for more than three months.

– Business trip allowances (as specified in the company’s regulations);

– Phone bill and office supply expenses (as specified in the company’s regulations);

– Clothing allowance for employees not exceeding 5,000,000 VND/person/year;

– In-kind clothing provision for employees, which is not counted as taxable personal income;

– Overtime or night shift income exceeding the amount of a regular workday;

– One-time relocation allowance stipulated in the collective labor agreement or labor contract: relocation from Vietnam to work abroad; relocation of foreigners or Vietnamese residing abroad for a long time to work in Vietnam.

– Transportation costs for employees to and from the workplace;

– Airfare for foreign employees or Vietnamese working abroad to return home once a year (including round-trip tickets);

– Tuition fees for the children of foreign employees or Vietnamese working abroad to study in Vietnam or the tuition fees for the children of Vietnamese working abroad to study abroad (up to high school level);

– Costs of training to improve employees’ skills and qualifications to meet job requirements;

– Lunch allowance exempt from personal income tax up to a maximum of 730,000 VND/month;

– Some in-kind expenses used for the collective of employees;

– Airfare for employees with a specific job requirement to rotate;

– Condolence and congratulation money (applicable for cash or in-kind amounts).

Additionally, according to Resolution No. 954/2020/UBTVQH14, the following deductions are applicable:

– Personal deduction: 11,000,000 VND/month (132,000,000 VND/year);

– Dependent deduction: 4,400,000 VND/month;

– Deduction for social insurance, health insurance, and unemployment insurance contributions deducted from employees’ salaries at the following rates for 2021: Social insurance (8%); Health insurance (1.5%); Unemployment insurance (1%);

– Deduction for charitable, humanitarian, and educational contributions.

For cases where the labor contract is less than three months or there is no labor contract, personal income tax will be calculated as follows:

According to Point I, Clause 1, Article 25 of Circular No. 111, the calculation of personal income tax is stipulated as follows:

For employees without a labor contract (as guided in Points c & d, Clause 2, Article 2 of this Circular) or with a labor contract of less than three months and with a total income of 2,000,000 VND or more per payment, the personal income tax shall be deducted at a rate of 10% on the income before payment to the individual;

For cases where the income per payment is less than 2,000,000 VND, the company temporarily does not have to deduct tax at a rate of 10% on the income before payment to the employee;

If an individual has only one source of income at a unit, but the estimated total taxable income after deducting the personal deductions does not reach the taxable threshold, the individual can make a commitment according to Form 08/CK-TNCN (according to Circular No. 80/2021/TT-BTC) for the unit paying the income to base on temporarily not deducting personal income tax.

According to Article 10 of Circular No. 111/2013/TT-BTC, the basis for calculating tax on investment income is taxable income and the tax rate. Taxable income from investment is the taxable income that individuals receive. In other words, individuals with investment income are obliged to pay personal income tax.

The amount of tax to be paid is calculated as follows:

Personal Income Tax = Taxable Income x 5%

Where:

Taxable income = Total investment income (after excluding non-taxable or tax-exempt amounts, if any).