If you are still struggling with managing your monthly personal expenses and achieving financial independence, then the following article is definitely for you.

1 Introduction to personal expense table

Introduction to personal expense table

Introduction to personal expense table

A personal expense table is, in the simplest terms, a collection of information related to personal finances such as expenses, investments, income, savings, etc. These are the types of expenses that need to be clearly and transparently stated in the personal expense table so that when you look at it, you can balance and regulate your expenses in a reasonable manner.

Unless you have multiple transactions, need to manage and participate in multiple financial matters and require assistance from experts, the majority of people can create their own personal expense table in a reasonable manner following the steps below. Let’s continue to follow!

Additional reference:

2 Identifying the components needed in a personal expense table

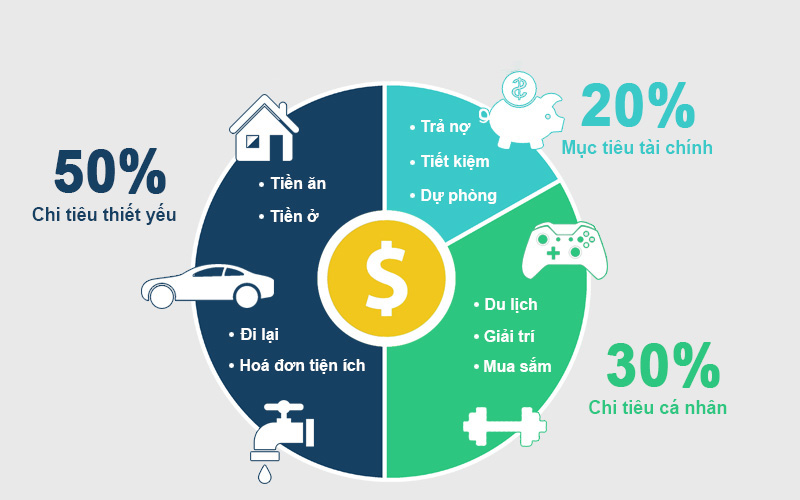

To have the most accurate personal expense table, you need to identify the personal financial components that you need to track daily. They can be the three main spending needs of yourself, or more. Specifically, they are the following three needs:

– Essential needs in life: These are the needs for food, electricity, water, internet, etc. These are essential needs in your daily life. Experts analyze that you need to use 50% of your personal financial resources to meet these needs.

Of course, if you spend beyond the 50% threshold, it means that you are running a budget deficit and need to adjust your spending process so that the essential expense is within the 50% limit. In this way, you will have a more reasonable personal expense table.

– Personal spending needs: Each person will have different needs in their personal expense category such as shopping, entertainment, travel, education, etc. These types of needs will account for 20% of your total personal income.

Personal expenses are flexible expenses. On the other hand, personal needs are always significant. Therefore, you need to control your spending so that this category accounts for about 20%, which is the most reasonable and optimal.

– Personal financial goals: These are the expenses for investment and accumulation for the future. Investment in stocks, insurance, real estate, gold, etc., or some people choose to invest in education, essential educational expenses for themselves, etc. These investments will make you care about the future. However, if you invest too much, the risk is high, and the necessary expenses for the present will also be affected. Therefore, 30% of total income for this category is the best.

Additional reference:

Adherence to financial expenditure categories according to the 50/20/30 method

Adherence to financial expenditure categories according to the 50/20/30 method

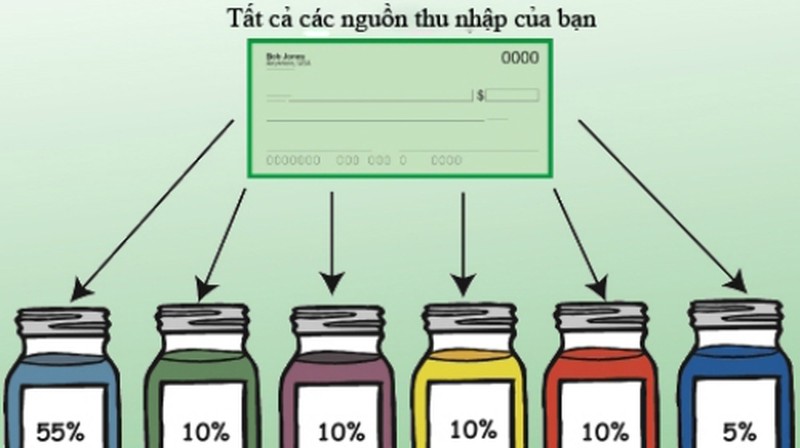

3 List income and expenses on a regular time basis

To have a reasonable personal expense table, you need to have a firm grasp of the income and expenses you have. Fixed income and expenditure will greatly support the control of the expense flow in the table.

Once you have those income and expenses, it will become very easy to create a personal expense table. One of the common ways chosen by many people is to create a personal expense table in Excel. When using this table, all expenses will be displayed. By doing this, you will know where you have spent your money, which areas need adjustments, attention, or additional supplements, etc.

List income and expenses on a regular time basis

List income and expenses on a regular time basis

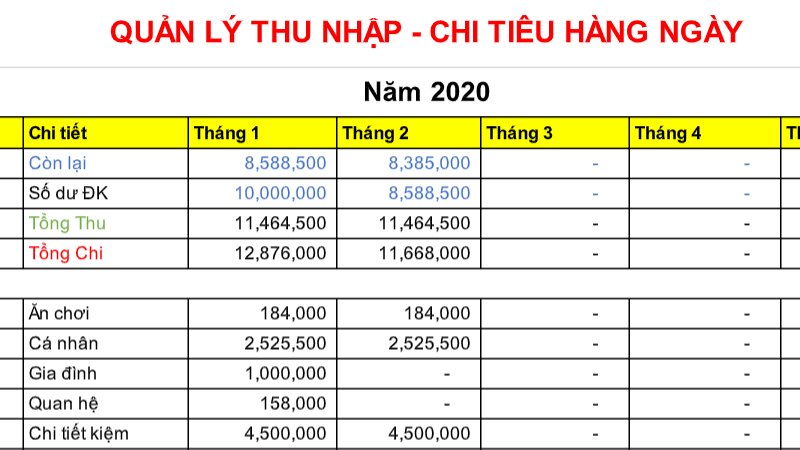

4 Time associated with expenditure categories

You may not pay attention to this, but time is one of the most important factors in expense management tables.

You need to set specific time milestones associated with your planned or budgeted expense categories. With specific time, you will have an invisible pressure as well as motivation to quickly organize and complete them.

Time associated with expenditure categories

Time associated with expenditure categories

5 Simple guide to creating an expense table in Excel

Excel is a powerful tool for creating personal finance management tables. This is not difficult because you just need to be familiar with the following principles to create the table.

When creating the table, divide the columns to enter information and data. The first column is for data entry, and the second column is for the goals. Remember to include information about your expense activities, such as essential needs, personal needs, and financial goals. With this content, you detail as much as possible to help the table visually and clearly.

After entering all the necessary information, you need to set specific time milestones to assign to your goals and accomplish them. For example, you need a certain amount within a specific time frame to save money.

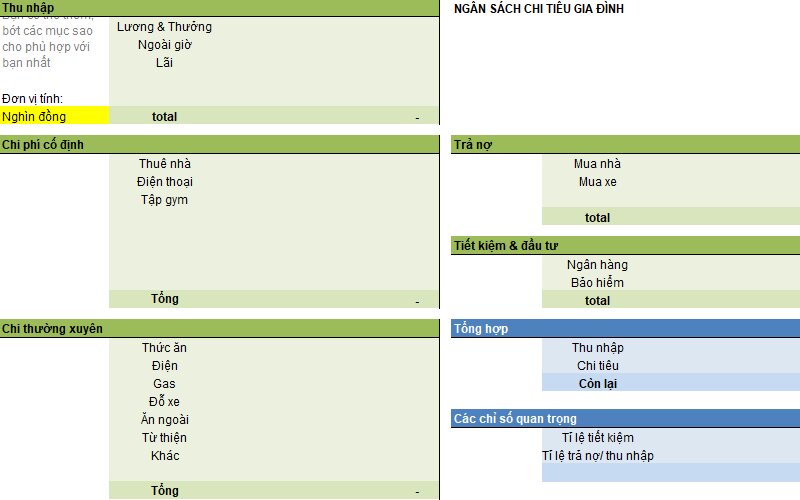

To create an expense management table, users use a separate Excel spreadsheet to easily manage. Here are the steps for creating your own personal expense table.

Step 1: Open the Excel application on your computer or phone.

Step 2: The creator needs to create two columns, one for income and one for expenses. This is an important step that the creator needs to fill in accurately and in detail to plan, monitor, and execute.

Step 3: When you have all the information in the Excel spreadsheet, you need to use simple commands to calculate. For example, you can use the sum command by clicking on the Autosum cell. Next, you click and drag the cells you want to calculate together. Then, press Enter to get the total. Apply this to both income and expense columns.

Expense table in Excel

Expense table in Excel

Step 4: Calculate the surplus or deficit amount each month. By performing simple calculations in Excel, you will get your result. A positive number means you have a surplus, while a negative number means you have a deficit.

Step 5: Copy to calculate the results for the following months.

Tracking expenses with an expense table

Tracking expenses with an expense table

Conclusion

Creating an expense management table in Excel is not difficult. With simple steps, you can control and adjust your expenses in a reasonable manner. Hopefully, the information provided above has provided you with useful knowledge. See you in the next articles!

Top 5 modern expense management apps, optimized for diverse user demographics.

Managing finances is a meticulous and challenging task that requires careful calculation. To ensure financial intelligence and organization, we rely on the assistance of expense management apps. So, which expense management software is popular and effective? Read on to discover the answer in this article by FPT Shop.