In life, there are always shortcuts to make things easier. The same goes for saving and financial management. There are a few simple tips that can go a long way in helping you save money. So, if you’re struggling with personal financial management, don’t stress; instead, check out these tricks to save a significant amount of money each month.

1. Fill up your gas tank on Monday mornings

Filling up your gas tank on Monday mornings is a smart choice if you want to save money. Typically, Mondays are less busy than other days of the week. Also, gas prices can be adjusted and tend to be higher during the week.

2. Pack your lunch

Ordering takeout with your colleagues can be fun, but did you know you could save around $294 a month by packing your lunch? Preparing your meals at home and bringing them to work can help you save money, and instead of spending money on takeout every day, you can choose to use it for a special occasion during the year.

3. Ditch the branded products

Sometimes, we get attracted to famous fashion labels that we don’t necessarily need. Consider switching to non-branded products with similar styles or designs if you want to save money. For example, with items like cereals or pasta, you can find cheaper alternatives in supermarkets without compromising taste…

4. Go cash-only

This is a good strategy if you want to save money. Try to use cash for your weekly expenses and limit your credit card usage. People tend to hold on to cash better than digital money. So, try to keep your major expenses on your card and use cash for the rest.

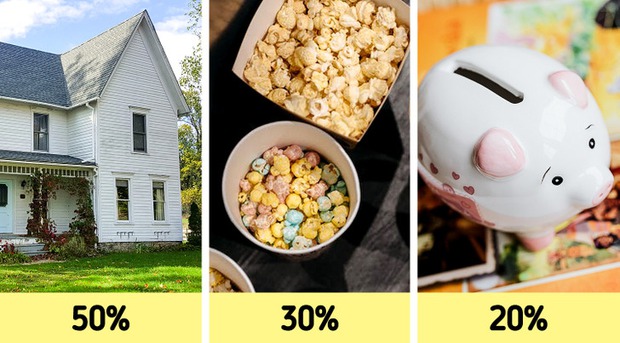

5. Follow the 50/30/20 rule

This is the perfect secret formula to keep your wallet full, even at the end of the month. Allocate 50% of your income to essentials like utilities, rent (if applicable), groceries, and debts (if any). Spend 30% on entertainment and allocate the remaining 20% to savings.

If you want to maintain a smarter lifestyle, stay away from earning money just for entertainment and be more responsible with your bills.

6. Implement the 24-hour rule for online shopping

Most people tend to shop online impulsively. To avoid regrettable choices, follow the 24-hour rule. Before deciding to buy a non-essential item, wait 24 hours before clicking the purchase button. This gives you time to think it over and decide if it’s truly worth it.

7. Cut down on cleaning products

Cleaning products (including laundry detergent and dish soap) are some of the most expensive items that you might not even realize. To save money, use as little of these products as possible. Most cleaning agents on the market are highly concentrated, so you don’t have to worry about using a small amount.

8. Grow your vegetables at home

If you have enough space, we recommend growing your vegetables. Don’t worry if you don’t have a large area; some veggies like tomatoes and beets are easy to grow in containers. This will not only save you money but also provide fresher produce and a new hobby.

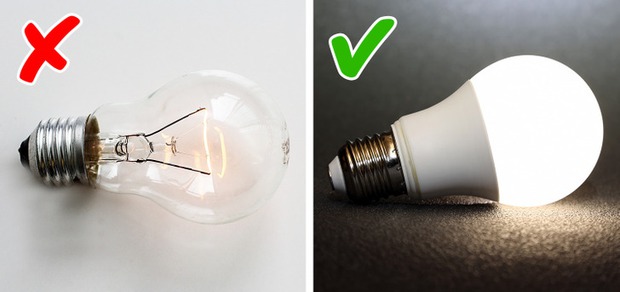

9. Switch to LED lighting

It’s a great time to invest smarter. Replacing your regular light bulbs with LED lights is a good idea if you want to save at least 75% of your energy usage. LED lights also last up to 25 times longer than incandescent bulbs, resulting in significant long-term savings.

10. Wash your clothes in cold water

Here’s another laundry tip. When using a washing machine, always rinse with cold water. This is because, when you use hot water, up to 90% of the energy used by the machine is for heating, which is more expensive. Switching to cold water can save you up to $63 a year.

According to Vietnamese Women

What is Family Spending? Secrets to Efficient Family Budgeting

Every month, we all face various receipts, from electricity and water bills to shopping receipts for essential items for our families. However, many families overspend, affecting their savings and personal finances. We are here to help you find the secrets to efficient and cost-effective family spending.