With the increasing demands of consumers, financial institutions and credit unions are established to meet everyone’s needs. However, this method of borrowing does not require a lot of paperwork but is quite simple. We will explore this method together.

1. Explore the installment loan package at FE Credit

When you go to a bank, you can borrow a large sum of money, but it is quite cumbersome and requires a lot of paperwork. On the other hand, with personal credit loans from financial companies, the loan amount is limited to a certain range, and the borrower cannot borrow more than the predetermined credit limit.

Cash installment loans at FE Credit are unsecured loans. This means that you can borrow without collateral or a third-party guarantor. Customers who need to borrow money will repay the debt by making equal monthly installments. This form relies entirely on the borrower’s credibility to obtain funds, with a high credit limit and a long repayment period.

Exchanging information with customers

Exchanging information with customers

2. Features and benefits of FE Credit installment loans

FE Credit’s installment loan service exists to meet the consumption needs of individuals whose financial capacity is insufficient to cover their expenses, allowing them to consume now and pay later in various forms.

Benefits of FE Credit installment loans:

-

No collateral required.

-

No guarantor required.

-

Low-interest rates starting from 1.4%/month.

-

Flexible repayment period ranging from 6 to 24 months.

-

Ability to make payments at any time.

-

Monthly installment payment support.

-

Simple terms and procedures.

-

Customer information confidentiality.

-

No file processing fees.

Exchanging information with customers

Exchanging information with customers

3. Interest rates and credit limits for FE Credit installment loans

Interest rates for FE Credit installment loans

Depending on the customer’s choice of unsecured loan product, FE Credit applies the appropriate interest rate. Currently, the most applied interest rates are 1.4%, 1.66%, 2.17%, 2.2%, and 2.95% per month.

When taking out a consumer loan at a bank or financial company, you will often come across two concepts: interest on the original debt and interest on the decreasing debt.

-

Interest on the original debt: Interest is calculated based on the initial loan amount throughout the loan term. The interest rate on the original debt is 2.2%/month.

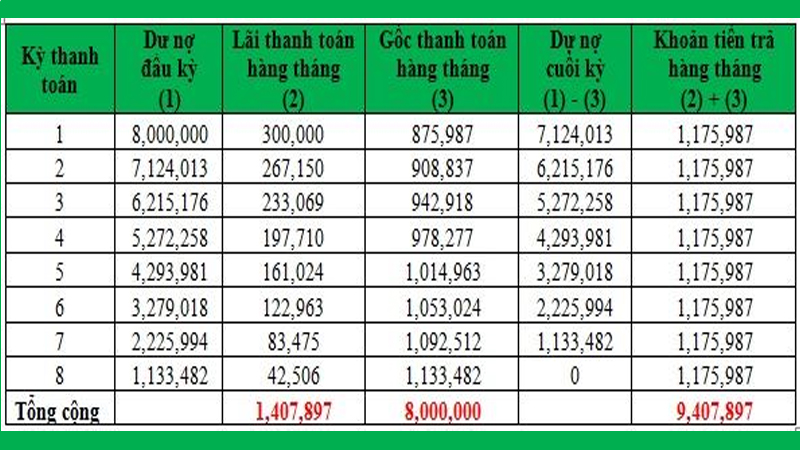

Monthly debt and interest payment table

Monthly debt and interest payment table

-

Interest on decreasing debt: Interest is calculated only on the actual amount you owe after deducting the principal you have paid in previous months. The interest rate on the decreasing debt is equivalent to 3.75%/month.

Monthly debt and interest payment table

Monthly debt and interest payment table

Therefore, regardless of the repayment method, the total interest you pay remains the same.

Maximum credit limit at FE Credit

At FE Credit, the maximum credit limit is up to 70 million VND, meeting the cash needs of all types of customers. This limit is based on the customer’s personal information, loan amount, and income level at their company.

For FE CREDIT PLUS cardholders:

-

Maximum payment/transaction: 15,000,000 VND.

-

Maximum cash withdrawal/transaction: 15,000,000 VND, not exceeding the limit set by the host ATM bank.

-

Maximum online transaction/transaction: 10,000,000 VND.

-

Maximum payment/day: 36,000,000 VND, but not more than 10 times/day.

-

Maximum cash withdrawal/day: 24,000,000 VND, but not more than 10 times/day.

-

Maximum online transaction/day: 15,000,000 VND, but not more than 5 times/day.

FE Credit Card

FE Credit Card

For FE CREDIT Gold cardholders:

-

Maximum payment/transaction: 20,000,000 VND.

-

Maximum cash withdrawal/transaction: 20,000,000 VND, not exceeding the limit set by the host ATM bank.

-

Maximum online transaction/transaction: 10,000,000 VND.

-

Maximum payment/day: 50,000,000 VND, but not more than 12 times/day.

-

Maximum cash withdrawal/day: 36,000,000 VND, but not more than 12 times/day.

-

Maximum online transaction/day: 20,000,000 VND, but not more than 5 times/day.

4. Forms of cash loans at FE Credit

When taking out a cash loan at FE Credit, customers can choose from the following options:

-

Cash loan with a Viettel primary SIM card: This is a new unsecured loan product at FE Credit. Customers can borrow up to 50 million VND over 30 months with a low-interest rate of only 1.4%/month. Note: This service only applies to long-term Viettel SIM cards. Mobifone, Vina, and Vietnamobile SIM cards are not eligible.

Viettel 4G SIM Card

Viettel 4G SIM Card

-

Unsecured consumer loan based on cash salary: Loan amount based on a minimum salary of 3 million VND, customers can borrow 6 to 8 times their salary, with a flexible loan period of 6 to 36 months and an interest rate ranging from 1.66% to 2.95% per month.

-

Loan based on bank-transferred salary: For customers who wish to borrow based on their monthly salary, with a minimum salary of 3 million VND, paid via a bank account. FE Credit offers a maximum loan amount of 70 million VND or 6 to 8 times the salary, with an interest rate of only 1.66% per month.

ATM Transfer

ATM Transfer

-

Installment loan based on electricity bill: Loan amount up to 40 times the monthly electricity bill (maximum 50 million VND). Flexible loan period ranging from 6 to 36 months with an interest rate of 1.66%/month.

Electricity Bill

Electricity Bill

-

Installment loan based on motorcycle registration: This loan option offers a small loan amount with simple requirements, requiring only the motorcycle registration and vehicle title. The loan amount can reach up to 30 million VND, with a loan period of 6 months to 3 years and a low-interest rate of only 2.17%/month.

-

FE Credit unsecured loan based on life insurance: Accepting all loan applications with life insurance contracts from insurance companies in Vietnam with a policy duration of at least 6 months, offering a loan amount of 10 to 70 million VND with a flexible loan period of 6 to 36 months and a minimum interest rate of 1.66%/month.

5. Conditions and procedures for FE Credit consumer installment loans

Conditions for FE Credit consumer installment loans

-

Age between 20 and 60 years old

-

No bad debts at any bank or financial company.

-

Stable income of at least 3 million VND/month.

-

Possession of one of the following documents: Household registration book/motorcycle registration/utility bill/credit card/life insurance.

Procedures for FE Credit consumer installment loans

The loan process will be quick and convenient if you prepare the following documents and fulfill the necessary procedures:

-

Household registration book or temporary residence book (KT3) (photocopy of the entire book)

-

Identity card (photocopy)

-

1 photo with dimensions of 3×4 cm.

-

Other necessary documents (depending on the loan option you choose)

Exchanging loan information

Exchanging loan information

6. How to register for an FE Credit installment loan (online, in person)

There are two ways to register for an FE Credit installment loan:

Online registration

Step 1: Access the FE Credit website or download the app on your Android or iOS phone.

Step 2: Choose the documents you have.

Step 3: Select the desired loan amount and loan term.

Step 4: Register the loan and fill in your personal information.

Step 5: Confirm that you are not a robot and submit the loan application for approval.

Online registration

Online registration

In-person registration at FE Credit

Detailed instructions on how to check if a Viettel sim card is eligible for a loan in 2024

Do you know how to check for a Viettel sim loan? Currently, borrowing money through Viettel sims is a hot trend that many people are choosing due to its fast process and favorable interest rates. However, not every sim is eligible for this. Let’s find out more about this issue in the following article!