1. Estimate Your Spending

Before creating a budget, it’s important to know exactly how much money you have coming in and your actual living expenses. Estimates or guesses are completely useless, as you might be spending more than you think.

“You should track your personal expenses for 1-2 months before creating a budget,” shared Barry Choi, a personal finance expert. “Make a list of everything you’ve spent. This way, you can see where your money has gone and create the most realistic budget,” Choi advised.

2. Don’t Buy Just Because of Discounts

Buying things on sale can be great, but buying things just because they’re discounted is a different story. Stores often use discounts and promotions to make you spend money on things you didn’t intend to buy in the first place – these are usually things you don’t really need or like.

Before purchasing a discounted item, think about whether you genuinely want it to the point where you’d be willing to buy it even without the discount. If the answer is yes, then go ahead. But if the answer is no, then you don’t necessarily have to buy it.

3. Don’t Neglect Financial Planning for Emergencies

Successful people always have comprehensive plans for major life changes. This allows them to adjust their expenses to fit events that can be planned for in advance, such as getting married, buying a house, having children…

For financially disadvantaged individuals, they often spend money as soon as they have it – living from paycheck to paycheck. They don’t have any savings, so when major unexpected events occur, they are financially unprepared. They rush to borrow money and carry the burden of debts.

To manage your expenses better, you should plan for long term and be prepared for significant changes in life. This small act will help you balance your finances and not affect your own and your family’s life.

.

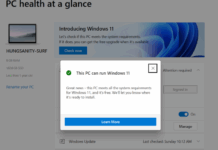

4. Unrealistic Expectations

You might be excited about improving your financial situation, but it’s important not to set goals that are too high. Budget plans that seem highly effective on paper often don’t bring the expected results or are unrealistic.

“When creating a budget, especially when trying to pay off credit card debt, people often set ideal numbers on paper, but they’re unrealistic,” Stephanie Genkin, a financial planner in Brooklyn, New York, said. Instead, Genkin advises people to start slowly with small steps. For example, bringing packed lunch to work twice a week and gradually increasing it to 5 days.

5. Don’t Buy with Borrowed Money

Using credit cards and borrowing money is an easy solution when you don’t have cash. Borrowing money for things you don’t really need will only worsen your financial situation. It’s best to spend only on what is necessary and consider taking up extra jobs or selling unnecessary items to generate additional income.

When you plan to go deep into debt, for example, borrowing money to buy a car or a house, you need to carefully consider the repayment terms. Make sure you have a detailed plan to pay off these loans. Also, you should make comparisons: is it necessary to borrow a lot of money to build a big house, or is it sufficient to build a moderately sized house?

6. Trying to Keep Up with Friends

The reality is your friends will never share about their finances or care about your budget. “If you try to keep up with your friends’ excessive spending, you might end up spending more than you can afford,” said Avery Breyer, author of “Smart Money Blueprint: How to Stop Living Paycheck to Paycheck”. This doesn’t mean you completely stop socializing with these friends. The important thing is to be aware of who you’re shopping with and stay mindful.

Source: Giadinh.net

Tips for Maintaining a Budget Following the Lunar New Year

After a year of hard work, it’s time to reunite with family and friends and celebrate the joyous Tet holiday! But with all the festivities that come along with it, it might be easy to overspend your hard-earned money. To stay within your budget, here are some helpful tips on how to enjoy the season without breaking the bank!