The ZaloPay app is a reliable electronic wallet with high security that many customers trust and use. Not only does it support quick and convenient online transactions, but ZaloPay also offers a Buy Now, Pay Later feature that allows users to make purchases and pay back the borrowed amount at the end of the billing cycle. If you’re not familiar with how to open a ZaloPay Buy Now, Pay Later wallet, then you must follow this article.

What is ZaloPay Buy Now, Pay Later?

ZaloPay Buy Now, Pay Later is a consumer financing product without collateral provided by CIMB Vietnam Bank. This wallet allows account holders to use a certain amount of money that corresponds to a specific credit limit to pay for various services on the ZaloPay app quickly and easily. These services include bill payments, mobile top-ups, shopping at stores, airline ticket booking, and more, all without requiring upfront payments.

/fptshop.com.vn/uploads/images/tin-tuc/173987/Originals/vi-tra-sau-zalopay-1.jpg)

With ZaloPay Buy Now, Pay Later, customers can spend and pay later with a credit limit of up to 5 million Vietnamese Dong per valid account. The interest rate is 0% for a maximum period of 37 days, and the monthly service fee is 15,000 Vietnamese Đồng.

Benefits of opening and using ZaloPay Buy Now, Pay Later wallet

The introduction of ZaloPay Buy Now, Pay Later wallet provides users with a convenient spending solution and reduces financial burdens in cases where immediate payment for a service is required but you don’t have enough money. Here are some of the benefits:

/fptshop.com.vn/uploads/images/tin-tuc/173987/Originals/vi-tra-sau-zalopay-2.jpg)

- Quick online registration: To use ZaloPay wallet, users can easily register and create an account entirely online from anywhere without the hassle of going to a bank and completing complex procedures.

- Freedom to spend within the allowed credit limit with 0% interest rate: You can spend within a specific credit limit, and if you pay before or on time within 37 days, the interest rate will be 0%.

- Convenience in urgent situations: If you’re late on your salary or have unexpected expenses with no money left, early registration will allow you to receive a 5 million Vietnamese Đồng credit limit, suitable for paying for essential services and shopping.

- Easy expense management: ZaloPay has an account management feature that allows users to track and control transaction history, total credit limit, outstanding balance to know what they have spent on and how much is remaining.

- Good security, safety, and reliability: As a product of CIMB Vietnam Bank, a member of the CIMB Group, personal information and transaction information on ZaloPay Buy Now, Pay Later wallet will be securely protected, ensuring no leakage or information theft.

/fptshop.com.vn/uploads/images/tin-tuc/173987/Originals/vi-tra-sau-zalopay-3.jpg)

Requirements to open ZaloPay Buy Now, Pay Later wallet

To open a ZaloPay wallet, you need to meet the following requirements:

- Have downloaded the ZaloPay app and created a ZaloPay wallet account.

- Be at least 18 years old and a Vietnamese citizen.

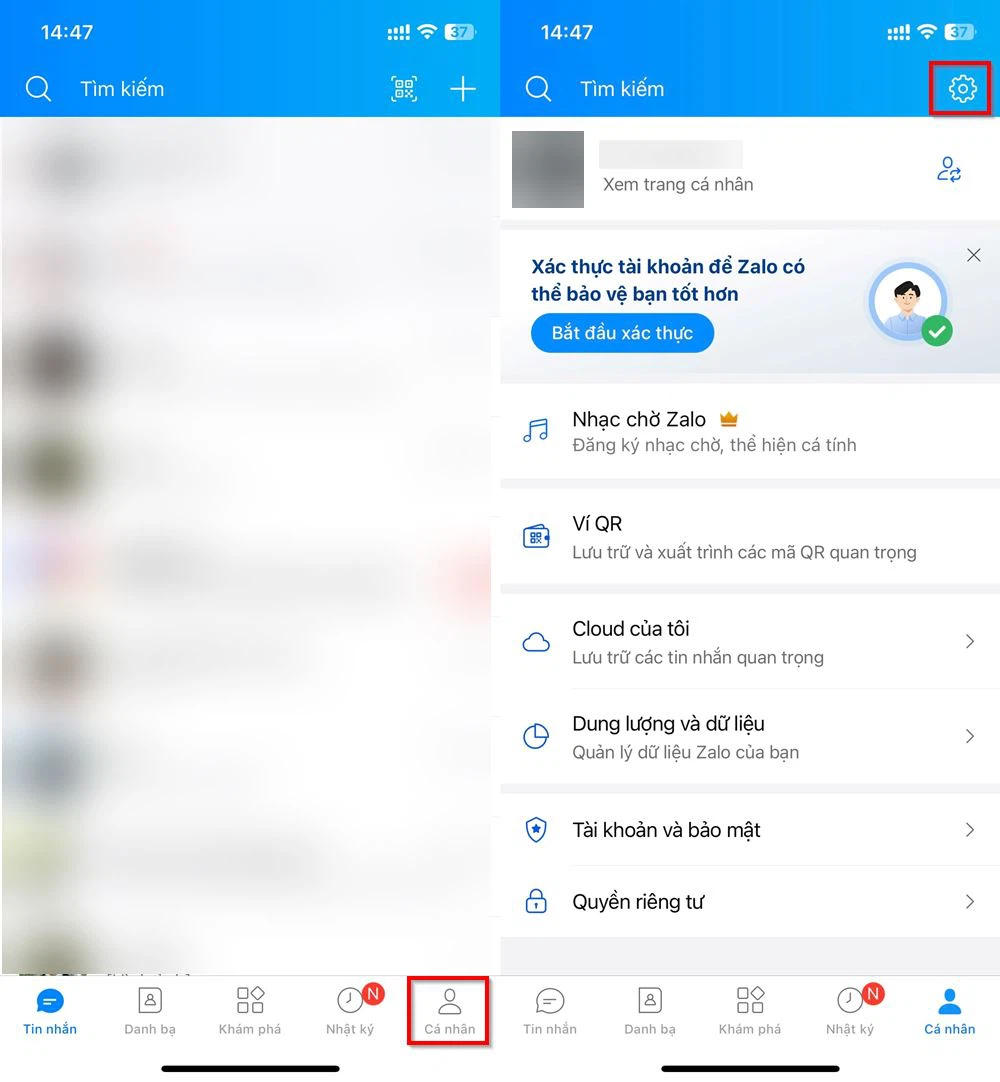

- Have a verified ZaloPay account.

- Meet the financial requirements set by ZaloPay, which may include monthly income, credit checks, or other financial information.

Download ZaloPay app for iOS: Here.

Download ZaloPay app for Android: Here.

Simple and quick steps to open ZaloPay Buy Now, Pay Later wallet

If you meet all the above requirements, follow the steps below to open your ZaloPay Buy Now, Pay Later wallet:

Step 1: Access the ZaloPay app > Select the Buy Now, Pay Later Account category on the home screen.

/fptshop.com.vn/uploads/images/tin-tuc/173987/Originals/vi-tra-sau-zalopay-4.jpg)

Note: Before that, you must ensure that your ZaloPay account has been verified.

Step 2: Read the instructions and select Check Registration Conditions.

/fptshop.com.vn/uploads/images/tin-tuc/173987/Originals/vi-tra-sau-zalopay-5.jpg)

Step 3: Fill in any missing personal information as required, check I confirm > Select Submit Application to proceed to the next step.

/fptshop.com.vn/uploads/images/tin-tuc/173987/Originals/vi-tra-sau-zalopay-6.jpg)

Step 4: Press Review Now to view the contract information > Sign in the blank field > Select Submit Contract.

/fptshop.com.vn/uploads/images/tin-tuc/173987/Originals/vi-tra-sau-zalopay-7.jpg)

Step 5: Then, the bank will send an OTP code to the phone number you used to register the ZaloPay wallet.

Enter this verification code accurately and select Done.

/fptshop.com.vn/uploads/images/tin-tuc/173987/Originals/vi-tra-sau-zalopay-8.jpg)

Step 6: After completing the process of opening ZaloPay Buy Now, Pay Later wallet, you can press Spend immediately to pay for services through the ZaloPay wallet app.

/fptshop.com.vn/uploads/images/tin-tuc/173987/Originals/vi-tra-sau-zalopay-9.jpg)

Credit limit and interest rate when using ZaloPay Buy Now, Pay Later wallet

The credit limit when using ZaloPay Buy Now, Pay Later wallet ranges from 500,000 to 5,000,000 Vietnamese Đồng. Additionally, each account will have a maximum fee limit corresponding to 20% of the shopping limit. For example, if your shopping limit is 5 million Vietnamese Đồng, the fee limit will be 1 million Vietnamese Đồng. This limit will be applied to deduct maintenance fees and ZaloPay Buy Now, Pay Later wallet usage fees in case the allowed limit has been fully spent.

/fptshop.com.vn/uploads/images/tin-tuc/173987/Originals/vi-tra-sau-zalopay-10.jpg)

The credit limit of the ZaloPay Buy Now, Pay Later wallet will be determined after your application has undergone verification and approval by CIMB Vietnam Bank. Information about the application result, granted credit limit, duration of maintaining the limit, as well as other information, will be notified on your ZaloPay wallet account.

ZaloPay Buy Now, Pay Later wallet is like an integrated credit card within the app, so the fee and interest rate calculation are similar to various credit cards currently circulating on the market. If you pay on time or before the due date within 37 days, there will be a 0% interest rate.

Starting from 8:00 PM on July 27, 2023, ZaloPay Buy Now, Pay Later wallet will apply the following service fees:

- Account activation fee: Free.

- Service fee: 20,000 Vietnamese Đồng/month.

One-time service fees will be incurred during the statement period when:

- Users use funds from the ZaloPay Buy Now, Pay Later wallet to pay for services on the ZaloPay app during the period.

- Customers have not fully paid the outstanding balance of the previous period before the due date has passed.

If, during the period, customers do not use the ZaloPay Buy Now, Pay Later account to pay for services and have no outstanding balances, no fees will be generated.

Frequently asked questions about ZaloPay Buy Now, Pay Later wallet

In addition to the shared information above, there are certainly many more questions you may have when opening and using the ZaloPay Buy Now, Pay Later wallet. Here are some frequently asked questions and detailed answers:

What are the fees for ZaloPay Buy Now, Pay Later wallet?

Currently, opening a ZaloPay Buy Now, Pay Later wallet is free, but users will have to pay a service fee of 20,000 Vietnamese Đồng/period if you are still using the service and have an outstanding balance. Additionally, if you fail to pay on time within the 37-day period, additional interest will be charged.

If I open a ZaloPay Buy Now, Pay Later wallet but don’t use it, will I be charged?

The answer is NO. If you have already opened a ZaloPay Buy Now, Pay Later wallet but have no intention to use it and have no outstanding balance, you don’t have to pay any fees.

/fptshop.com.vn/uploads/images/tin-tuc/173987/Originals/vi-tra-sau-zalopay-12.jpg)

Can I withdraw money from ZaloPay Buy Now, Pay Later wallet?

The answer is NO. You cannot withdraw money from the ZaloPay Buy Now, Pay Later wallet because this is cash provided by the bank for you to pay for transactions made through the ZaloPay app.

Conclusion

Above are the important information you need to know about ZaloPay Buy Now, Pay Later wallet, how to open the wallet, and the applied credit limit and interest rates. If you regularly have transactions that can be done through the ZaloPay wallet app and are temporarily short on funds, you can download and use ZaloPay Buy Now, Pay Later wallet to overcome temporary difficulties.

Learn more:

- How to transfer money from ZaloPay to MoMo?

- Simple ways to withdraw money to a linked bank account in the ZaloPay app.

To download and use the ZaloPay app, you need a mobile device such as a smartphone or tablet. Visit FPT Shop now and choose the right device for you.