In 2020, Caz Mooney and her husband were only living on fixed monthly salaries.

But just one year later, the Caz Mooney household (living in Offaly County, Ireland) had to change their habits to establish sustainable finances, ensuring a better future for the whole family.

This mother of three also revealed the secret to paying off credit card debt and saving nearly 400 million VND to make a down payment for a house by cutting out all unnecessary expenses in 12 months. Surprisingly, she only needed 1 year to achieve this.

Caz Mooney said she and her husband started budgeting in 2021 because they struggled with renting a house, credit card debt, and being stuck in a lifestyle with only one source of income.

Caz Mooney had a spectacularly successful year paying off debt and saving money for her family’s first home.

Sharing with RSVP Live, she said: “We wanted to be able to buy our own home. We were also concerned because we did not see many affordable rentals within our budget. That’s why we knew we had to make changes to make our family’s finances more secure.”

“We came back and had a large credit card debt after a vacation in the US. On the plane ride back home, my husband turned to me and said: “What are we going to do? Maybe it’s time we made some changes in our spending habits.”

Since then, Caz and her husband committed to tight financial control. They also wanted to save enough to buy a home for their family.

In 2021, they started with a year of cutting expenses to the extreme, meaning they only bought essential items.

This basic step involved saving every penny and not buying anything unless absolutely necessary, such as groceries.

“It was a tough year but we really changed our mindset about money,”, Caz said.

Caz and her husband sat down with their two children and explained what needed to change during that year.

“We explained to the children that we need to save for the goal of owning a home.

Accordingly, the whole family will create as many good memories as possible through various activities and joyful experiences that are not related to money.”

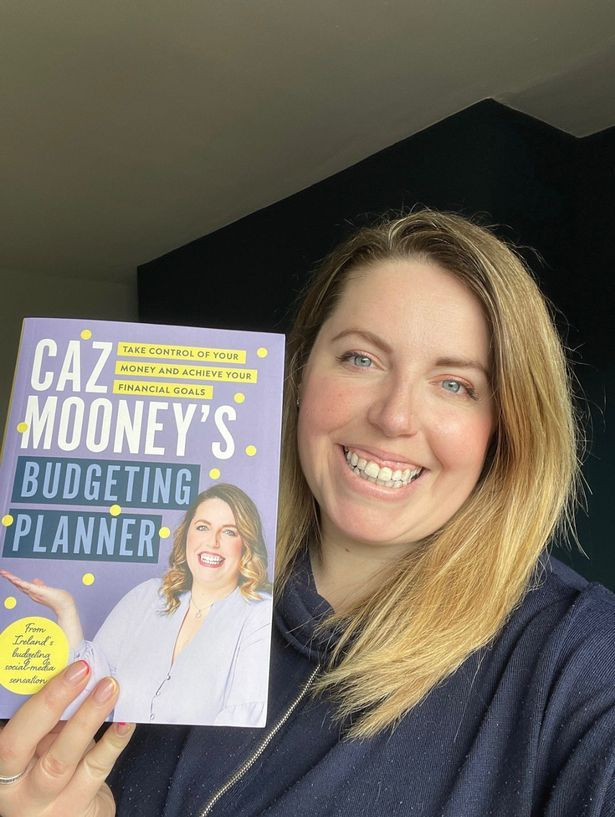

Caz started sharing helpful advice on social media for other families with limited budgets and has now written a book.

Fortunately, the children were all on board with this idea. Regarding free family activities, Caz took a map of Ireland and drew a one-hour radius around where they live and shared that the whole family can choose any place within that radius to visit.

“We spend the whole day there. We hike in the mountains, visit lakes, explore our local area. We bring picnic food or food that we have prepared together at home,”, Caz added.

Caz also participated in Come Dine With Me with her friends – where everyone cooks a three-course meal for the rest of the group and they need to give feedback.

Caz shared: “We let the kids participate and luckily, they enjoy it.”

The couple also organized a vacation that year by staying at a friend’s place while they were away.

“We started to notice a significant increase in the money at the end of each month,” Caz happily said.

A year of frugal spending was a big success for the family’s finances. The Caz family paid off their credit card debt by the end of December 2021 and saved nearly 400 million VND.

“In January 2022, we had the keys to our new home. It’s such an achievement, I’m sure the kids will never forget it,” Caz emphasized.

Regarding budgeting, Caz has some practical advice such as starting with small changes. However, it may take 3 months for you to see noticeable changes.

“Try not to limit the number of things you need to buy or force yourself to cut back too much.

For example, with a grocery store, if you are too restrictive, you are more likely to break the budget and end up buying takeout food.

You need to find a healthy balance… and allocate the necessary budget for these expenses so that you don’t overspend on other items,” she said.

Caz also emphasized that planning is a key component of budgeting.

“If you plan to go out during the day, bring your own lunch. Pay attention to eating out or buying takeaway coffee because when you add it all up, the amount of money can certainly be surprisingly high. There’s nothing wrong with doing these things, but you need to plan and try to avoid impulsive spending.

That’s advice for breaking subconscious spending habits. You should also unsubscribe from shopping newsletters which can be helpful,” she added.

Caz further advised that if you find yourself living from one paycheck to another, this can make you feel quite anxious and insecure. So try to find other income sources to be more proactive.

According to Vietnamese Women

Runner-up reveals the secret to strengthening a married couple’s relationship in times of stress

Ha Thanh residents in their 70s reveal the secret to nurturing and arranging beautiful flower vases loved by millions