When it comes to saving, it can be more engaging than you might imagine. The appropriate monthly savings amount varies for each individual based on their goals. The following information will assist you in determining your own savings figure.

One of the fundamental principles of personal finance is saving money. However, many people struggle with getting started because they are uncertain about where to begin. It is important to remember that the amount you should save each month will depend on your specific goals. Here are some key points to consider when determining your monthly savings amount:

How much should you save each month?

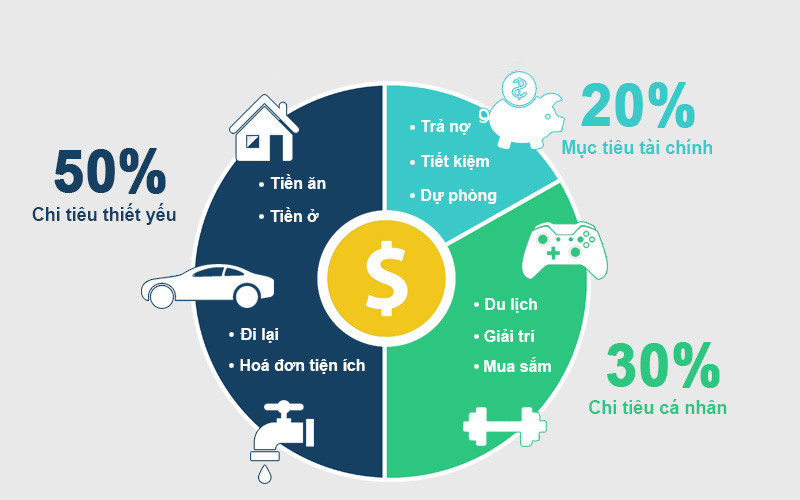

For many individuals, the 50/30/20 rule is an effective way to allocate their monthly income. According to this budgeting rule, you should allocate 50% of your monthly income to necessities (such as housing, groceries, and utilities), 30% to wants (such as entertainment, travel, and shopping), and 20% to savings.

Why is 20% the recommended savings figure?

While the recommended savings figure can vary depending on whether it is for retirement or emergency savings, it is generally advisable to allocate 10% to 20% of your income towards savings.

If you are unable to save 20% of your income, save whatever amount you can. The goal is to gradually increase your savings to reach 20% of your income for both retirement and emergency savings.

Financial planner Laura Davis states, “There is no universal percentage that is suitable for everyone; the key is to start saving as soon as possible.”

Where should you allocate your savings?

Chad Parks, a financial expert and CEO/founder of Ubiquity Retirement Savings, advises starting by addressing your immediate needs in order to determine how to allocate your savings for emergencies or retirement.

Specifically, he recommends calculating how much you can save each month and then deciding where to allocate those funds. If you do not have at least 6 months’ worth of living expenses saved, Parks suggests putting 80% of your savings toward building an emergency fund and allocating the remaining portion for retirement savings. Once you have established an adequate emergency fund, this allocation ratio should shift to prioritize retirement savings.

For example, if you earn $3,500 per month and can afford to save 10% of your income (equivalent to $350), you should allocate $280 towards your emergency fund and $70 for retirement savings. Adjust these figures based on your specific circumstances.

Consider your individual situation and personal needs when making savings decisions. The ultimate goal is to increase your savings. If you are unable to allocate 10% to 20% of your income for savings, start with whatever amount you can and gradually increase your savings over time.

Strategies for increasing your savings:

Track your expenses: Utilize apps, spreadsheets, or a simple notebook to keep tabs on your spending. Without a clear understanding of your income and outflow, effective saving becomes challenging.

Automate your savings: Instead of saving whatever is leftover after expenses, establish an automatic transfer of a designated amount to your savings account whenever you receive income. This ensures consistent monthly savings without the need for constant decision-making.

Cultivate good saving habits: Even if you are unable to save 10% of your income each month, building the habit of saving is crucial. Every small amount saved contributes to progress towards your financial goals.

Gradually increase your savings: Once you have established a savings habit, incrementally increase the amount you save as you reach new milestones. Additionally, ensure that your savings are being directed to the most effective investments.

Consider your investment options: The key to successful saving strategies lies in ongoing progress and growth.

Reassess your savings following significant life events: Whenever you experience job changes, salary increases, or unexpected bonuses, prioritize increasing your savings rather than contemplating how to spend the extra funds.

5 cách đơn giản sắp xếp tủ lạnh tiết kiệm được nhiều tiền

Người Nhật tiết lộ cách tiết kiệm tiền tối ưu

13 cách giúp bạn tiết kiệm tiền hiệu quả

Tips for Maintaining a Budget Following the Lunar New Year

After a year of hard work, it’s time to reunite with family and friends and celebrate the joyous Tet holiday! But with all the festivities that come along with it, it might be easy to overspend your hard-earned money. To stay within your budget, here are some helpful tips on how to enjoy the season without breaking the bank!