Customs procedures can be challenging for beginners who are unfamiliar with the process and the required steps. Let’s explore the step-by-step guide to customs procedures for beginners in the article below!

1. Steps for Import Customs Clearance

The requirements vary depending on the nature of the goods. The following steps are very basic and can be adapted according to your specific situation when engaging in this activity.

Step 1: Identify the Type of Goods

Not all imported products are allowed into the Vietnamese market. Only selected goods are imported to ensure the domestic consumer market remains unaffected. This step involves identifying the following types of goods:

Ordinary Commercial Goods

These are goods that meet the standards for import into the domestic market.

Goods that meet standards

Goods that meet standards

Prohibited Goods

These goods are specified in the APPENDICES of Decree 187/2013/ND-CP. It is crucial to carefully check the goods before deciding to import them, as importing prohibited items can result in penalties or serious legal consequences.

Prohibited Imports

Prohibited Imports

Goods Requiring Import Licenses

These goods are listed in the Appendix of Decree 187/2013/ND-CP. It is mandatory to complete the necessary procedures and obtain the required documents before the goods arrive at the port. Otherwise, your goods may be detained at the port and unable to be released into the market.

Chemicals requiring import licenses

Chemicals requiring import licenses

Additionally, you may incur extra costs for container and warehouse rental, among other expenses, causing losses to your business.

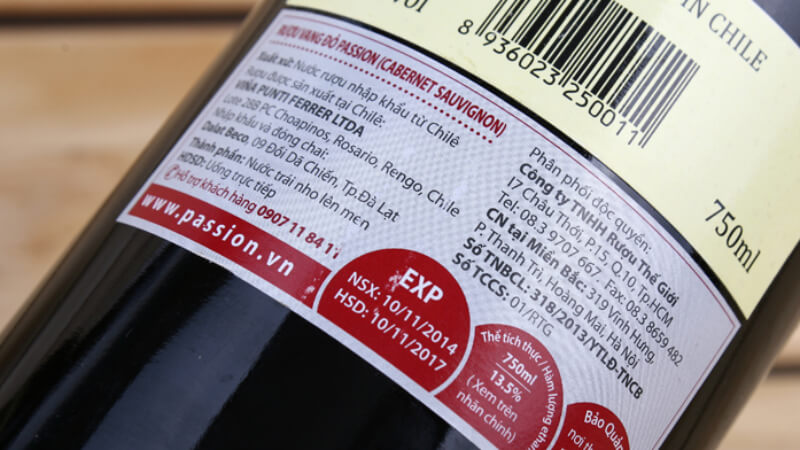

Goods Requiring Conformity Declaration

Conformity declaration is mandatory for goods in Group 2 (those with potential safety hazards). For other goods, it is voluntary if the business wants to enhance its reputation and product quality.

For a better understanding of the conformity declaration process, refer to Circular No. 28/2012/TT-BKHCN.

Conformity Declaration Label

Conformity Declaration Label

Goods Requiring Specialized Inspection

Specialized inspection is conducted after the goods have arrived at the port. Specifically, authorities will take samples from some packages to check if they meet the specialized standards.

Currently, there is no document specifying the types of goods requiring this inspection. However, each ministry will provide regulations based on the characteristics of its respective industry.

Specialized Inspection

Specialized Inspection

This is an essential step in customs procedures that beginners need to understand to prepare the necessary documents carefully and avoid delays in releasing goods into the market, saving time, effort, and money for businesses and ports.

Step 2: Sign the Foreign Trade Contract (Sale Contract)

This document is crucial to demonstrate the voluntary nature of the transaction between the two parties. It includes basic information such as the name of the goods, quantity, weight, specifications, and price.

Additionally, pay close attention to the terms and conditions in the contract, as they may require additional documents and incur different fees.

Signing the Foreign Trade Contract

Signing the Foreign Trade Contract

Each industry will have different clauses tailored to the nature and characteristics of its products. The contract is drafted in English for both parties, as it is an international transaction.

Step 3: Check the Goods’ Documentation

The documentation for the goods includes:

- Commercial Contract

- B/L (Bill of Lading): Transport Bill

- Commercial Invoice: Commercial Invoice

- Packing List: Detailed List of Goods

- C/O (Certificate of Origin): Certificate of Origin of Goods

- Other documents depending on the goods and agreements between the parties

Checking Goods Documentation

Checking Goods Documentation

The seller will provide this documentation after the goods have been loaded at the port. Usually, they will send hard copies, so if there are issues such as missing or incorrect information, you will need to make corrections or additions, which can be time-consuming and incur additional costs, hindering the process.

Therefore, always carefully check the information in the documentation during the exchange with the seller. Pay attention to details such as the type of goods, product description, unit price, and quantity to ensure accuracy and make timely corrections or additions if necessary, so the documents match.

Step 4: Register for Specialized Inspection (if applicable)

If your goods fall into the category of goods requiring specialized inspection, this step is mandatory. It is advisable to perform this step in advance, immediately after receiving the Arrival Notice (notice of goods arrival), to save time when the goods arrive at the port. You will receive the notice of goods arrival from the carrier 1-2 days before the ship arrives at the port.

Register for Specialized Inspection

Register for Specialized Inspection

The registration requirements may vary depending on the specific industry to ensure compliance with the regulations of that industry. If your goods are not on the list of items requiring specialized inspection, you can skip this step.

Step 5: Declare and Transmit Customs Declaration

This step requires your business to have a digital signature and register it with the Vietnam Customs Department. You can use the VNACCS system of the Vietnam Customs Department for free. However, in practice, many businesses purchase customs declaration software from certified IT companies for simplicity and convenience.

The customs declaration form contains various information that you need to fill in accurately, such as port code and customs code. Prepare and provide detailed information to avoid mistakes that would require redoing the form. Seek guidance from experienced individuals to avoid unnecessary errors and save time.

Declare and Transmit Customs Declaration

Declare and Transmit Customs Declaration

Once you have completed the form, transmit it to obtain a number. If the form does not meet the requirements, it will be canceled, and you will have to start over, which is time-consuming.

This step is considered challenging in the import procedures, so to increase the chances of obtaining a number quickly, businesses may opt for customs declaration services depending on their specific needs.

Step 6: Obtain the Delivery Order

The Delivery Order (D/O) is a document issued by the forwarding company to request the cargo storage unit to deliver the goods to the recipient. To obtain the delivery order, you need to prepare some documents and take them to the carrier, specifically:

- 1 copy of Identity Card

- 1 copy of the Bill of Lading

- 1 original Bill of Lading with the signature and seal of the company’s leader

- Payment of fees

Delivery Order

Delivery Order

The longer the goods are stored at the port, the higher the costs will be. Therefore, you need to be proactive and continuously monitor the process to ensure the timely delivery of goods to the market.

Step 7: Prepare the Customs Dossier

The system will automatically categorize your customs declaration into one of three channels. Depending on the channel, you will need to prepare the relevant documents.

Customs Dossier Categorized into Three Channels

Customs Dossier Categorized into Three Channels

Green Channel Declaration

This is a positive sign as your declaration has been approved without the need for additional checks. The next simple step is to pay the taxes, print the approved declaration, print the barcode from the website of the Vietnam Customs Department, and go to the Customs Supervision Department to complete some procedures and collect the goods.

Yellow Channel Declaration

Some reasons why your dossier may fall into the yellow channel are:

The dossier contains unreasonable points: If you can provide clear explanations and meet the additional requirements set by the customs, your dossier will be approved, and you can proceed with the goods collection.

The dossier contains inaccurate or insufficient information: You may need to re-declare and transmit the customs declaration, so it is advisable to have someone in the office assist with retransmitting the declaration to save time.

The dossier contains contradictions: Your goods will be subject to direct inspection (similar to the red channel) to prevent cases of fraudulent declaration. This may lead to risks of the goods not being allowed for import. Therefore, prepare your customs dossier carefully and meticulously.

If your declaration falls into this channel, the customs authority will inspect the paper dossier of the imported goods, specifically:

- Letter of introduction of the person performing customs procedures of the enterprise

- Printout of the customs declaration

- Copy of Commercial Invoice (COmmercial Invoice)

- Copy of Bill of Lading (Bill of Lading) with the company’s seal and the seal of the carrier

- Copy of Freight Invoice (if delivered under FOB, Exwork, etc.)

- Original Certificate of Origin of Goods (C/O – Certificate of Origin)

- Copies of other documents such as Certificate of Quality (Certificate of Quality), etc.

To be safe, you can prepare additional copies of other documents, although they are not required, such as Sales Contract, Packing List, etc.

Red Channel Declaration

In this case, your goods show signs of violation and must undergo direct inspection. This step is called “Kiểm hóa,” which includes two parts:

- Document Inspection: Prepare the dossier of documents

- Goods Inspection: Prepare a letter of introduction and a valid delivery order.

The customs authority will first inspect your dossier and make requests such as providing additional information or retransmitting the declaration, depending on the specific case.

Then, they will proceed with the goods inspection. Based on the customs’ assessment, the goods will be inspected at a rate of 5%, 10%, etc. The inspection can be done through X-ray scanning or direct testing to evaluate discrepancies between the actual goods and the declared information, such as incorrect type of goods or quantity. Depending on the degree of violation, the enterprise will be handled according to the law. If no violations are found, the customs will approve the release of the goods.

Step 8: Pay Taxes and Complete Customs Clearance for Import

Immediately after the customs declaration is approved, proceed to the tax payment step. This step must be completed before clearance. The taxes you need to pay are:

- Import tax and value-added tax (VAT)

- Depending on the case, you may also need to pay environmental tax and special consumption tax

For more details on taxes, refer to Decree No. 57/2019/ND-CP,

Explore 12 Amazing Destinations for Biking Trips

Unlock Vietnam in a brand new way with an exciting biking tour! Discover the stunning beauty of the country with Dien May XANH’s top 12 must-see destinations. From sweeping plains to clear blue beaches and mountainous vistas – experience all the sights with your own personal cycling tour. Find your ideal route and set out for an adventure today!